OTTAWA – The Canadian auto industry is reacting with skepticism to the launch of final zero- emission-vehicle (ZEV) sales mandates released by its federal government, warning it needs to do more to spur demand, especially for electric vehicles.

In a joint statement released after Tuesday’s unveiling in Toronto of a new Canadian “Electric Vehicle Availability Standard,” the Canadian Automobile Dealers Assn. (CADA), the Canadian Vehicle Manufacturers’ Assn. (CVMA) and Global Automakers of Canada all raised affordability concerns about EVs.

CADA president Tim Reuss says: “With the current high interest rates and high inflation severely impacting consumer affordability, many consumers lack the means to purchase EVs, as evidenced by the rising inventory levels on our members’ lots. Instead of attempting to dictate what individuals have to purchase, we suggest government focus on creating the right set of circumstances to stimulate demand.”

Indeed, the standard retains the basic ZEV sales goals in the Liberal government’s 2022 draft: 20% of new cars, SUVs and pickups sold in Canada by 2026 are to be zero-emission vehicles; 60% by 2030; and 100% by 2035 (see chart, below).

But the government has moved a little toward market preparation by easing manufacturers’ ability to buy compliance credits by making investments in charging infrastructure. Under the final rule, manufacturers and importers can allot up to 10% of their ZEV sales commitments through investing in fast-charging public facilities with rated power of at least 150 kW. For each C$20,000 ($15,000) invested until December 2027, they can sell one more combustion-engine-driven vehicle, until 2030, than allowed under the mandate formula.

There is also greater flexibility for manufacturers to sell hybrids with a longer electric-only range of 80 km (48 miles) and above, which now can comprise up to 20% of ZEV sales from 2028 and beyond.

And the government has encouraged more early adoption of ZEVs by offering “early action credits” for ZEV sales in 2024 and 2025, which can be used to offset combustion-vehicle sales until 2027 of up to 20% of overall sales.

Canadian environment and climate-change minister Steven Guilbeault argues that these steps will resolve “the limited availability and long wait time” for consumer purchases of EVs.

“This is the main problem. We will do this by ensuring that more electric cars come to the Canadian market rather than the U.S. or other markets that have similar targets,” he says.

He claims price parity with ICE vehicles will come by the early 2030s at the latest and that for EV hatchbacks, for example, 10-year charging and maintenance costs compared to fueling and repairs for ICE hatchbacks would save consumers more than C$30,000 ($22,500) per vehicle.

However, David Adams, president of Global Automakers of Canada, says his members, including BMW, Hyundai, Volkswagen, Nissan and Honda, remain concerned that to hit these targets the industry will have to wrestle with “many other factors outside of its control...not the least of which is consumer acceptance.”

“The jury is still out regarding consumer sentiment on electric vehicles,” he tells Wards.

“The jury is still out regarding consumer sentiment on electric vehicles,” he tells Wards.

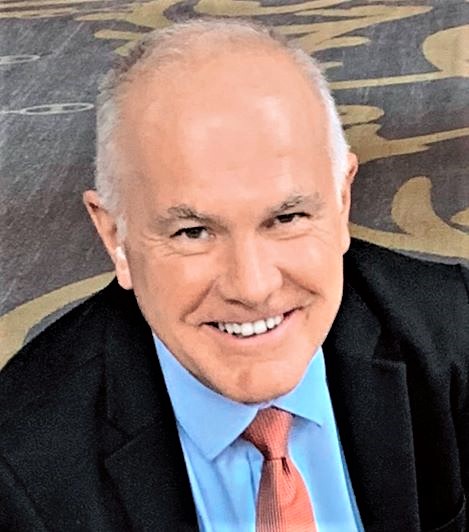

Consumers lacking home charging points must be prepared to wait in line 20 minutes or longer to access a public charger, Adams (pictured, left) notes. And consumers prepared to put up with this inconvenience and the current additional price for an EV “have already purchased a vehicle,” making future sales “more difficult” for manufacturers and dealers, he adds.

In Adams’ view, the government could have done more to persuade fleets to switch to EVs, including community car networks.

Brian Kingston, CVMA president (pictured, below left), warns: “Regulating vehicle sales will make life even more unaffordable for Canadians. Achieving 100% ZEV sales requires a comprehensive, long-term plan to support ZEV adoption that includes stronger consumer purchase incentives, a widespread public charging network and enhancements to the electricity grid to prepare Canada for more ZEVs on the road.”

Ross McKenzie, a Canadian auto industry marketing and research specialist, is also skeptical about the impact of the targets, doubting automakers will refuse to sell consumers combustion vehicles if they have sold too many ICEs in a quarter.

Ross McKenzie, a Canadian auto industry marketing and research specialist, is also skeptical about the impact of the targets, doubting automakers will refuse to sell consumers combustion vehicles if they have sold too many ICEs in a quarter.

“You can’t mandate consumer preference. It’s an aspirational goal rather than something that will be realized,” he tells Wards, “But we have to start somewhere.”

Guilbeault stresses that the Canadian government is investing public money into charging points, predicting 85,000 would be installed nationwide by 2029. The Canada Infrastructure Bank has allotted C$500 million ($375.4 million) on ZEV charging and hydrogen refueling, while the government’s Zero Emission Vehicle Infrastructure Program is “on track” for delivering 33,500 chargers by 2026, the meeting was told.

Brendan Sweeney, managing director of the Trillium Network for Advanced Manufacturing, which raises public and investor awareness of Ontario’s auto sector, agrees that rolling out charging points is feasible.

“Building a lithium mine (to supply EV battery manufacturers) is 10-out-of-10 in terms of complexity while installing chargers where there is already electricity is two-out-of-10,” he says.

The opposition Conservatives in the federal government – now flying high in the polls for an election to be held by October 2025 – say they will scrap the targets. By then the policy might have become established and tough to shift, Sweeney says. And given EVs are coming anyway, Canada could benefit in “getting ahead of this transformation” by building and selling more green autos, he adds.

Tesla Model 3 among Canada’s best-selling EVs.