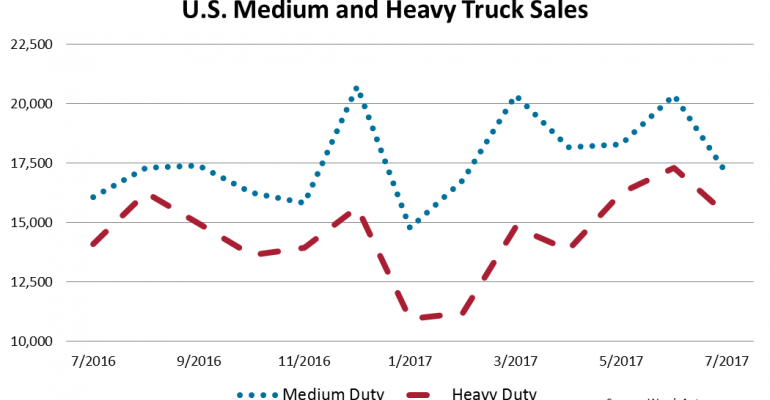

For the second month in a row, U.S. Classes 4-8 saw year-over-year growth with 32,367 units in July compared to last year’s 30,146. Even with that 11.7% increase for the month, medium- and heavy-duty truck sales fell 5.7% short of year-ago with 225,445 deliveries.

U.S. Class 8 trucks finally achieved growth with 15,317 units, 13.1% above last year’s 14,085. Daimler’s Freightliner (+22.5%) and Western Star (+19.4%) both grew leaving Daimler with 40.7% market share and 6,229 deliveries. International increased sales 32.4% to 1,625 units. Kenworth grew 8.4% and sister brand Peterbilt, 20.3%. Volvo Truck, down 14.1%, was the only manufacturer in the group to drop with Mack (-13.4%) and Volvo (-14.6%) having double-digit losses.

Even though Class 8 had a good month, year-to-date sales still were 15.7% behind 2016 with the first six months of the year having year-over-year declines.

Medium-duty truck sales rose 10.4% in July and 4.1% through the first seven months with 125,797 deliveries.

Class 7 sales rose 8.8% to 5,501 units with volume leader International accounting for 39.2% of market share and 2,154 units. Freightliner remained flat with 2,123 truck sales. Hino saw the greatest growth, up to 149 units from 2016’s 90, a 72.2% increase. PACCAR’s Kenworth and Peterbilt also grew, up 22.3% and 6.8%, respectively. Ford, although on small volume, tumbled 15.7% with 171 deliveries, the only truck maker to fall in this group.

Sales in Class 6 had moderate growth of 1.1% to 4,406 units on mixed results. Volume leaders Ford and Freightliner underperformed in July, falling 12.6% and 10.8%, respectively, and dropping from 71.3% to 62.3% together in market share. International (+49.4%) and PACCAR (+48.3%) climbed in sales for the month.

Class 5 led the medium-duty truck segment in volume, hitting 5,899 deliveries, a 16.2% rise from 2016’s 5,280. Daimler soared with triple-digit gains from Freightliner (+309.3%) and Mitsubishi Fuso (+182.3%) to 629 units from last year’s 162. Kenworth more than doubled its volume from five to 11 units. Ford grew 2.9% to 3,392 units and 57.5% market share. FCA outperformed last July with 1,244 deliveries, a 29.2% increase. Hino’s import line was up 78.1%. International and Isuzu were the only ones to see declines, dropping 79.9% and 25.7%, respectively.

Seeing the biggest improvement in July, Class 4 truck sales came in 30.6% ahead of like-2016 with 1,244 deliveries compared with year-ago’s 991. Daimler tripled its sales from 20 to 80 units with Freightliner entering the scene. Isuzu’s domestic line outperformed last July with a 32.7% rise in sales while imports came in 8.0% below year-ago.

Class 8 ended July with a 62 days’ supply, down from 85 from like-2016. A total of 38,034 units were in stock at the end of the month, down from 45,932 year-ago.

Medium-duty days’ supply decreased to 91 from 92 last July. Total units in inventory rose to 61,896 from 56,995.