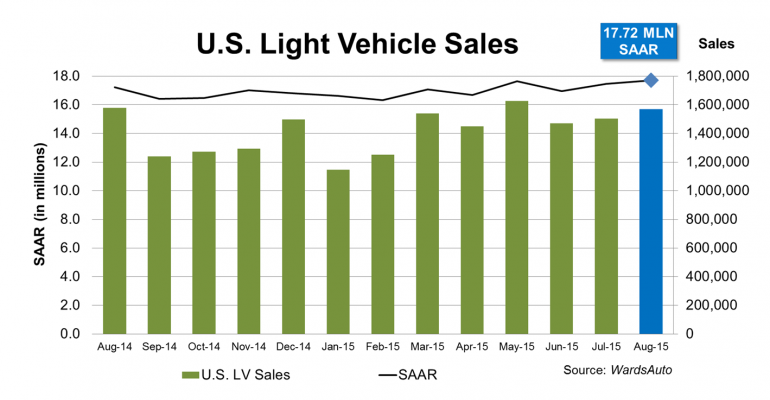

Boosted by demand for trucks, especially CUVs, pickups and fullsize vans, the seasonally adjusted annual rate for U.S. light-vehicle sales topped the 17 million-unit mark for the fourth consecutive month in August, the first time that’s happened since 2000.

August’s 17.7 million-unit SAAR was a 10-year any-month high, and well above year-ago’s 17.2 million, which was the best for all of 2014. The year-to-date SAAR totals 17.1 million units, well above year-ago’s 16.4 million and a 10-year high for the January-August period.

Volume totaled 1.569 million units for a daily selling rate of 60,354 over the month’s 26 selling days, 3.3% above August 2014’s 58,451 DSR – 27 selling days. Year-to-date sales through the first two-thirds of the year total 11.56 million units, 3.9% above 8-month 2014’s 11.13 million.

Positive economic indicators, such as jobs and income growth, consumer confidence and housing among others, largely were are behind the sales surge.

Incentives did appear to play a slightly bigger role in lifting volume as data from TrueCar indicated incentive levels as a percentage of transaction prices have been slowly rising and were at long-time highs in July and August.

In particular in August, there were some truck segments, such as Large Pickups and Large CUVs, that might have benefitted from increased spiffs, considering the size of their sales increases compared with their below-year-ago inventory levels coming into the month.

Fleet penetration in August, estimated by WardsAuto from third-party sources, was up slightly from year-ago.

While trucks recorded their 60th straight year-over-year increase (12.3%), cars declined for the third straight month (-6.8%). Trucks in total posted all-time high August market share of 57.3%, and year-to-date penetration of 55.3% is a record for the 8-month period.

CUVs again were the primary vehicles responsible for the robust results, with August sales up a whopping 17.2% from like-2014. All CUV segments posted increases over year-ago, with the biggest gains in Small, Small Luxury and Middle Luxury.

Indeed, combined August sales of Small and Small Luxury CUVs increased 70% from year-ago as share jumped to 5.4% from 3.3% in same-month 2014. Year-to-date volume for the two segments was up 38%.

Also, import volume for CUVs increased 34% from August 2014, with LV share reaching 9.4%, compared with 7.2% a year ago.

The boom in CUV imports boosted August’s penetration for overseas-built vehicles to 22.2%, highest for any month since July 2012 (22.3%). August sales of imported LVs were up 8.3%, compared with a 1.9% increase for domestically built vehicles.

Despite ending July with inventory 18.5% below year-ago’s total, sales of Large Pickups increased 8.9% in August and share rose to 12.6% from like-2014’s 12.0%. Small Pickups were up a whopping 36%.

Thanks to increases in pickups, vans and CUVs, sales of large trucks, after some recent weakness, increased 7.5% in August and market share rose to 19.5% from year-ago’s 18.8%. However, sales of Large SUVs, including luxury versions, were down 2.0%, lowering the year-to-date comparison to 1% below last year.

Not only did all car-segment groups record year-over-year declines in August, but nearly every segment except Middle Specialty and Luxury Sport, which together account for under 2% of the market, finished below year-ago.

All automakers except Honda, Mazda and Toyota posted increases from year-ago in August.