BMW is the company suppliers most like to work with, while Chinese auto makers, Renault, Fiat and General Motors’ European operations are among the bottom-ranked companies in a global survey by analysts IHS Automotive Consulting.

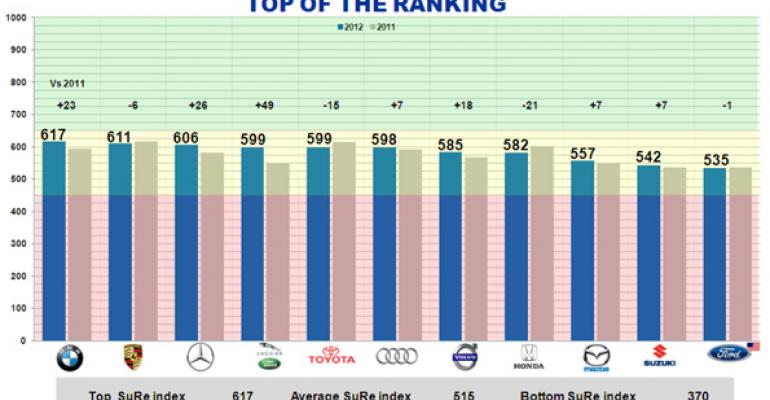

The report scores BMW at 617 on the IHS Supplier-Relations (SuRe) Index, a jump of nearly 23 points from year-ago and knocking Porsche (611) off the top spot. Suppliers cite the potential for higher profits with BMW, which in earlier surveys had been losing favor among its parts makers as a result of a 4-year cost-cutting effort.

IHS says Toyota (599) and Honda (582) both lost ground in the ratings in North America, similar to a trend spotted in the U.S. by consultants Planning Perspectives, which also does a survey of supplier attitudes. Chrysler (519) and General Motors (507) posted gains in their home market, though both are ranked by suppliers among the middle tier of auto makers.

Tata-owned Jaguar-Land Rover continued its steady improvement of the last couple of years, moving into the No.4 slot on the SuRe Index. IHS Senior Consultant Matteo Fini says as demand for its vehicles has ramped up, JLR has been more concerned with ensuring supply than clamping down on cost, a choice that appears to please the supply sector.

Ford, whose U.S. operations finished among the top-ranked auto makers, finally is seeing its scores advance in Europe, as well, IHS says. It’s truly becoming “One Ford,” the consulting firm says, but notes the auto maker’s U.S. rating has become stagnant.

Nissan’s SuRe score dropped 30 points in the past year, a fall attributed to aggressive price-reduction demands some suppliers report to be as high as 5% per year. IHS says the Japanese auto maker’s plunging scores are bringing it closer to partner Renault, which ranks among the 11 lowest-rated OEMs.

Also at the bottom of the pack are China’s SAIC, Dongfeng, FAW and Chery. IHS considers FAW and Russia’s AvtoVAZ to have slipped into the “critical area,” with scores of 421 and 391, respectively.

The IHS survey is based on 230 responses, 46% from North America, 40% from Europe, 10% in Asia and 4% in Africa and the Middle East. It covers 52 of the world’s top 100 suppliers, 85 medium-size firms and 93 small companies.

The survey, started in 2005, asks suppliers to rate global auto makers in a number of areas surrounding profit potential, trust, organization, pursuit of excellence and overall outlook.