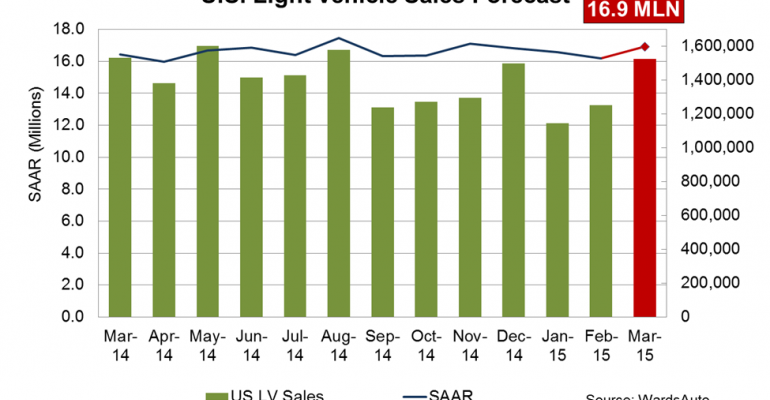

A WardsAuto forecast calls for U.S. automakers to deliver 1.52 million light vehicles this month. The forecasted daily sales rate (DSR) of 60,935 over 25 days represents a 3.5% improvement from like-2014 (26 days). With one fewer selling day, total sales for the month are expected to fall just shy of year-ago, despite what should be the industry’s best March DSR since 2000.

If overall sales volume does fall below year-ago, it will be the first year-over-year decline in LV deliveries since February 2014. March sales face particularly strong year-ago comparisons across the industry, as that period saw a significant spike from make-up sales due to unusually cold weather across the country in January and February 2014.

The report puts the seasonally adjusted annual rate of sales for the month at 16.9 million units, compared with year-ago’s 16.4 million and February’s 16.2 million mark.

The forecast reflects reports of strong retail activity in the first part of the month, as well as an expected boost in fleet orders for a number of OEMs. Japanese automakers in particular should see large month-to-month gains in DSR as they wind up their fiscal year.

Inventory at the end of February was a robust 3.6 million units, more than enough to support the forecasted DSR. WardsAuto expects month-end stocks to near 3.7 million units and leave the industry with a 60 days’ supply at the end of the month, down from 69 days the prior month and 62 days last year.

WardsAuto is forecasting General Motors will deliver 252,000 light vehicles, a 2.5% gain in DSR versus year-ago. The market’s No.1 auto seller should account for 16.6% of the market, compared to 18.5% of February LV sales.

The report calls for Ford’s DSR to rise just 0.5% from year-ago, but the automaker’s projected 231,000 LV deliveries would move it to the No.2 sales spot occupied by Toyota in February, despite a downturn in expected fleet orders, with Ford grabbing 15.2% of the market compared to 14% the prior month.

Toyota daily sales are expected to rise 8.6% from the company’s strong year-ago results. Strong fleet sales should help propel Toyota to 225,000 LV deliveries and a 14.8% share. FCA’s projected 12.9% share, and forecasted deliveries of 197,000 units would mark the company’s 60th consecutive month of year-over-year sale gains.

The forecast calls for Nissan’s DSR to dip 1.9% from its record-setting year-ago sales, while Honda is expected to see its daily sales grow 9.1%. Nonetheless, the forecast calls for Nissan to outpace Honda, for the third consecutive month, by a thin margin. Both companies are forecast with 9.2% shares on roughly 140,000 deliveries.

Hyundai Group, including Kia, is the only other Top 7 automaker expected to fall below year-ago levels, with forecasted DSR falling 2.5% on projected sales of 114,000 units.

At forecast levels, March LV sales would bring first-quarter deliveries to 3.92 million units, a 5.2% gain over same-period 2014. WardsAuto is currently forecasting 16.8 million LV sales for calendar year 2015, with a total Q1 SAAR approaching 16.6 million.