Better, more trustworthy communication in some sectors and rising profit potential in others have sparked an improvement in relations between automotive suppliers and their OEM customers around the world, an annual survey released today by Colorado-based consultancy IHS reveals.

The survey, said to be the only one conducted on a global basis, continues to rank BMW and Porsche as the top-two preferred customers for suppliers but shows industry relations overall improving.

The chief factors in the 21-point year-over-year jump in the overall IHS SuRe (Supplier Relations) score are the better long-term profit picture for some OEM customers, such as Chinese auto makers, and a rise in “Trust” ratings for others, including Ford and Hyundai.

Easing price pressure in some cases also may be contributing to the rising scores for a few, but the movement is not industrywide, the study notes.

Premium car makers such as BMW, Daimler, Audi, Porsche and Jaguar Land Rover continue to tighten their grip on suppliers when it comes to component pricing, and suppliers rated 11 of 35 OEs in the survey lower in the “Profit Potential” category that covers pricing, payment terms and reimbursement for tooling and development costs.

“It is clear that as premium OEMs start to see their profit dip, they will push suppliers to deliver critical savings to prop up their bottom lines,” Matteo Fini, IHS senior consultant and author of the study, says in a statement. “What matters is the magnitude of the purchasing savings they try to achieve and whether suppliers are supported in finding ways to achieve these savings, or they are asked to achieve them singlehandedly.”

But some of that increasing pressure at the high end of the market is being offset by an easing in the tactic by producers of more-mainstream brands, such as Fiat and Nissan, and the “Profit Potential” ratings gap is closing in general between the premium and volume auto makers, IHS says.

Even though Fiat has reduced pressure, it remains among the most demanding when it comes to price reductions, the survey finds. The French auto makers also have been among the toughest in that regard, a sign of the current financial condition of those struggling OEMs.

“PSA seems to be looking rather aggressively for additional ways to reduce its costs base through suppliers,” Fini says. “This can lead to a long-term deterioration of its relationship with suppliers.”

Renault is identified as the OEM requiring the biggest annual price reductions, the study reveals.

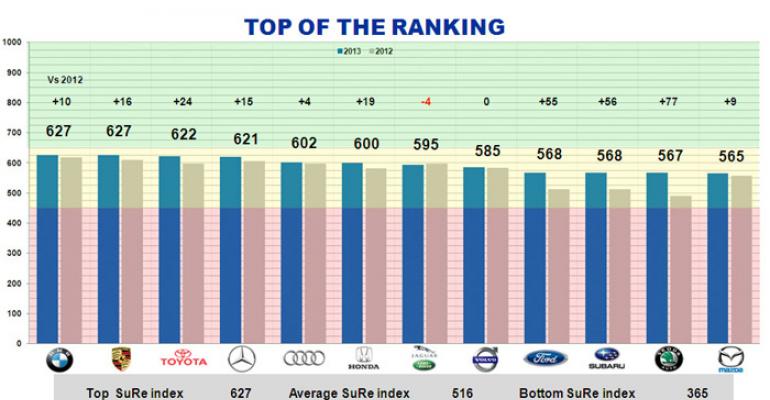

Closely following BMW (627 rating) and Porsche (627) in the overall rankings is Toyota (622), which gained 24 points from year-ago and Daimler (621).

Nineteen auto makers are rated above the industry-average score of 516, including Nissan, Honda, Subaru, Volkswagen, Hyundai and Kia. Among the 19, Skoda (567) exhibited the biggest improvement, gaining 77 points, and Jaguar Land Rover (595) was the only auto maker to post a decline, falling four points.

Although the Detroit Three each are rated above average, Ford (568) is No.9 in the rankings and gained 55 points from year-ago, while Chrysler (527) and General Motors (520) barely make the cut.

“Ford shows bold commitment to improving supplier relations, with a few interesting initiatives,” Fini says. “GM and Chrysler have addressed some of the deepest flaws in their relationship with the supply base, but still have major issues. For example, both appear weak in giving credit to suppliers’ cost-reduction efforts.”

Ford outranked GM and Chrysler in a similar survey conducted in North America by Michigan-based Planning Perspectives, results of which were released in May. That study also ranked BMW the best in supplier-OEM relations.

Below-average OEMs include several emerging-markets auto makers, many of them new to the study, including China’s BYD, Great Wall, Changan and SAIC-GM-Wuling and India’s Mahindra.

But IHS says other nascent OEMs it has tracked in previous studies recorded some of the most significant improvements year over year, including China’s Chery, FAW and Shanghai Auto, though they remain in “critical territory” on the SuRe index.

Industrywide, the “Trust” rating improved 5% from 2012 levels. Suppliers report Volkswagen, Skoda, SEAT, BMW and Mercedes in particular are more supportive, having launched initiatives to improve communications and help parts makers achieve quality targets.

Similar to the Planning Perspectives study, even the highest-rated auto makers are posting less-than-satisfactory scores in the IHS report. The consultancy says a SuRe rating higher than 650 is considered satisfactory, while scores below 450 indicate supplier relations are poor. Sixteen auto makers fall below the industry average, including nine that posted sub-450 scores.

The IHS report is based on a 29-question survey of 280 executives from 50 of the world’s top automotive suppliers, 49% in North America, 32% in Europe, 15% in Asia and 4% in Africa and the Middle East.