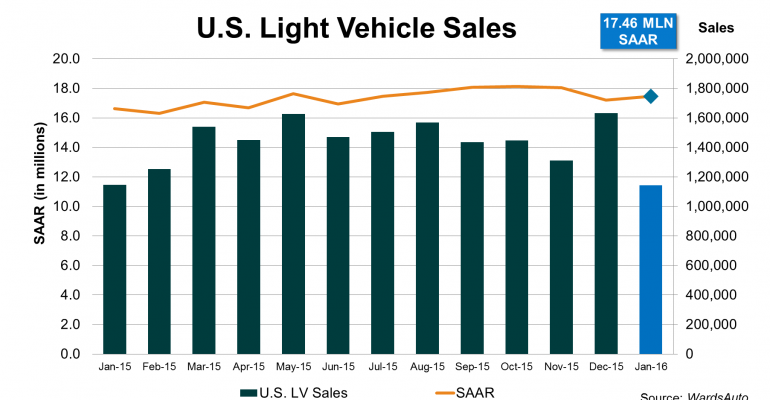

U.S. sales started 2016 on a high note reaching a 17.5 million-unit seasonally adjusted annual rate, a nice rebound from December’s 17.2 million, and well above year-ago’s 16.6 million.

January’s result left the 6-month trailing SAAR – a better indicator of current conditions compared with 1-month totals – at 17.8 million same as it was at the end of December and equal to WardsAuto’s forecast for the entire year.

Volume totaled 1.142 million units, slightly below same-month 2015’s 1.147 million, but the year-ago month had two extra selling days (26). January’s daily selling rate over its 24 selling days of 47,590 was 7.9% above year-ago’s 44,115.

A heavy mid-month snow storm that shut down much of the East Coast for several days appeared not to have a lasting negative effect on the month’s final total.

However, based on estimates by WardsAuto using third-party data, fleet volume contributed to January’s gains. After declining year-over-year in December, following five straight increases that included double-digit gains in October-November, the initial estimate for January shows fleet deliveries rose significantly from a year ago.

Also, data from TrueCar indicates average incentives in January increased from year-ago at a higher rate than average transaction prices, another likely contributor to the industry gain. But transaction prices did increase year-over-year for the 34th straight month, a sign that solid underlying demand exists, irrespective of rising incentives.

The major shift to trucks that started when gasoline prices began a precipitous decline in mid-2014 continued in early 2016. Light-truck penetration recorded a high for January of 58.7%, with CUVs also posting a record for the month.

CUV sales were up 17.1% from like-2015, and LV penetration climbed to 31.2% from year-ago’s 28.7%. Spearheading the segment group’s January results were a year-over-year increase in Small CUVs of 74% and a combined 30% gain among all three luxury segments, including a doubling in volume for the Small Luxury nameplates.

Sales of pickups increased 9.7% from year-ago, including a 13.5% rise in Small Pickups led by the relatively new GMC Canyon and recently redesigned Toyota Tacoma. Even the venerable Nissan Frontier recorded a 17.5% gain. The segment will get another boost when the new Honda Ridgeline hits dealer lots in the second quarter.

Large Pickups increased sales 8.9% over January 2015 with major increases from the Chevrolet Silverado, GMC Sierra, Ram Pickup and redesigned Nissan Titan. Ford F-Series was up a tepid 1.6%, while Toyota Tundra declined 4.4%, its sixth straight shortfall.

January deliveries in the Small and Large Van segments increased by whopping totals of 34.6% and 25.2%, respectively.

In Small Vans, combined sales of FCA’s Chrysler Town & Country, Dodge Grand Caravan and Ram ProMaster City rose 79%. Surges from year-ago in volume for the Chevrolet City Express, Nissan Quest, Toyota Sienna, as well as the new Mercedes Metris, pumped the segment too.

Large Vans were spurred by demand for the Ford Transit, Ram ProMaster and Nissan NV.

SUVs were up 6.7% thanks to a big gain in the Middle SUV segment, hiding the lukewarm results of the group’s other segments. An 84% rise in Dodge Durango sales from January 2015, with help from solid increases by the Jeep Grand Cherokee and Toyota 4Runner, propelled Middle SUVs to a 13.1% increase.

Despite a 31% increase in Large Cars, likely boosted by fleet deliveries, January car sales declined for the sixth time in the past seven months.

While Small and Luxury Cars slipped 3.4% and 5.4%, respectively, from year-ago, Middle Cars posted a slight increase, thanks in large part to the high-volume Lower Middle segment, which was helped by big gains from the Buick Verano, Ford Fusion, Honda Accord, Subaru Legacy, Toyota Camry and first-month sales of the redesigned Chevrolet Malibu (up 34.5%).

Nearly every automaker posted a gain from year-ago in January, with increases above the industry average from Daimler, FCA, General Motors, Hyundai, Jaguar Land Rover, Kia, Nissan, Porsche, Subaru and Volvo. Only Volkswagen/Audi and Tesla, which is estimated pending a revision when more data becomes available, recorded declines in the month.