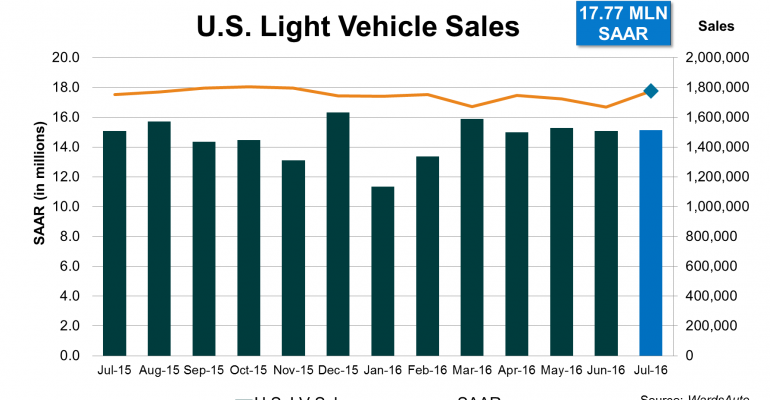

U.S. sales jumped to an 8-month high in July, based on seasonally adjusted annual rates, while volume nudged slightly above year-ago, keeping alive the possibility that calendar-year 2016 will top 2015’s record 17.38 million units.

July’s 17.8 million-unit SAAR was the highest since November’s 18.0 million and well above year-ago’s 17.5 million.

Note that based on new factors provided by the Bureau of Economic Analysis, the SAARs have been revised back to January 2013, thereby changing some previously published monthly totals.

Also, due to FCA US’s revisions to its own data caused by the change in its methodology for determining monthly sales volumes, adjustments were made to WardsAuto data for January-July 2016 and for like-2015. However, additional minor adjustments to the monthly totals are likely pending FCA’s release of more detailed revisions to its historical data.

The month’s actual volume increased less than 1% from July 2015, with more strength coming from retail deliveries than fleet volume for only the second time this year. Based on WardsAuto estimates using data from third-party sources, July retail volume increased 0.8% from like-2015, while fleet volume declined 0.3%.

Retail volume apparently was aided by increased incentive activity. Based on data from TrueCar, incentives rose 5.2% in July from like-2015. The increase coincided with a drop in average transaction prices and the incentives-to-ATPs ratio rose to 9.9% from 9.8% in June and 9.6% in July 2015. July’s ratio was the highest in several years.

July sales totaled 1.514 million units, compared with year-ago’s 1.507 million – 26 selling days both months – bringing year-to-date volume to 10.1 million, 1.1% ahead of January-July 2015’s 10.0 million.

Sales of light trucks increased 7.6% in July from like-2015 and penetration totaled 61.1%. Small and Middle CUVs, Vans, Large SUVs and Small Pickups were mostly responsible for the truck gain. Small Pickup demand increased 28.9% in July from same-month 2015, thanks in part to the new Honda Ridgeline, which nearly matched the GMC Canyon in volume. Oddly, while other players in the segment soared in July, segment leader Toyota Tacoma recorded its second straight decline.

Car deliveries fell 9.0% and were down 8.2% for the year through July. Only two car segments, Lower Small and Middle Luxury, which combine for a mere 5% of the market, recorded increases.

Demand for just a few vehicles in the Lower Small segment, including platform siblings Hyundai Accent and Kia Rio, as well as Nissan Versa and Scion iA, have made it the only car segment with higher volume year-to-date vs. 2015. Despite a 2.3% increase in July, Middle Luxury cars were down 14.5% year-to-date.

To a certain extent, the bigger the automaker, the worse its year-over-year July results.

Sales for each of the top three companies declined from a year ago, while No.4, FCA, was flat. Honda, riding a wave of new products, posted a 4.4% increase in July, and No.6 Nissan was up 1.2%. Honda was the only automaker among the top six that posted a decline in car sales less than the industry average. In total, sales for the top automakers were down 0.6% in July.

Including estimates for Jaguar Land Rover, which reports July results tomorrow, sales for the industry excluding the Top 6 increased 4.1% in the month, led by Volvo (up 52.8%), Daimler (7.1%), Kia (6.5%), Hyundai (5.6%), Subaru (3.1%) and Mazda (2.8%). Also, an initial estimate for Tesla, which will be revised, had its results up 2.4%. Only BMW and Volkswagen/Audi/Porsche recorded declines in July.

Strength of the smaller companies, which account for about one-fourth of the market, largely was in CUVs. Cars were down 5.0% for the group, but that was better than the 13.0% decline by the Top 6, especially from FCA (-27.8%) and GM (-19.8%).