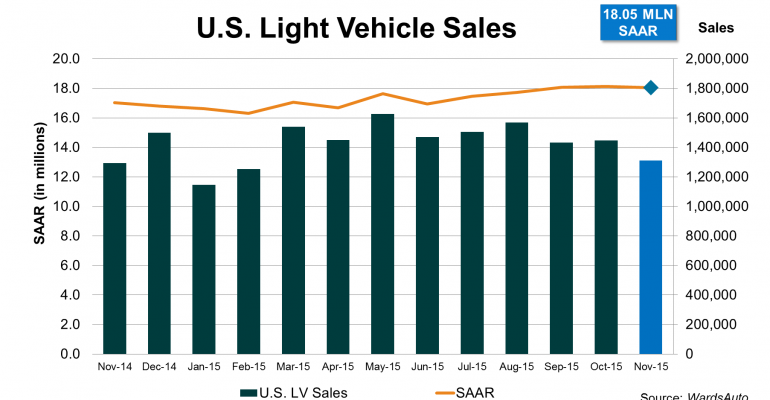

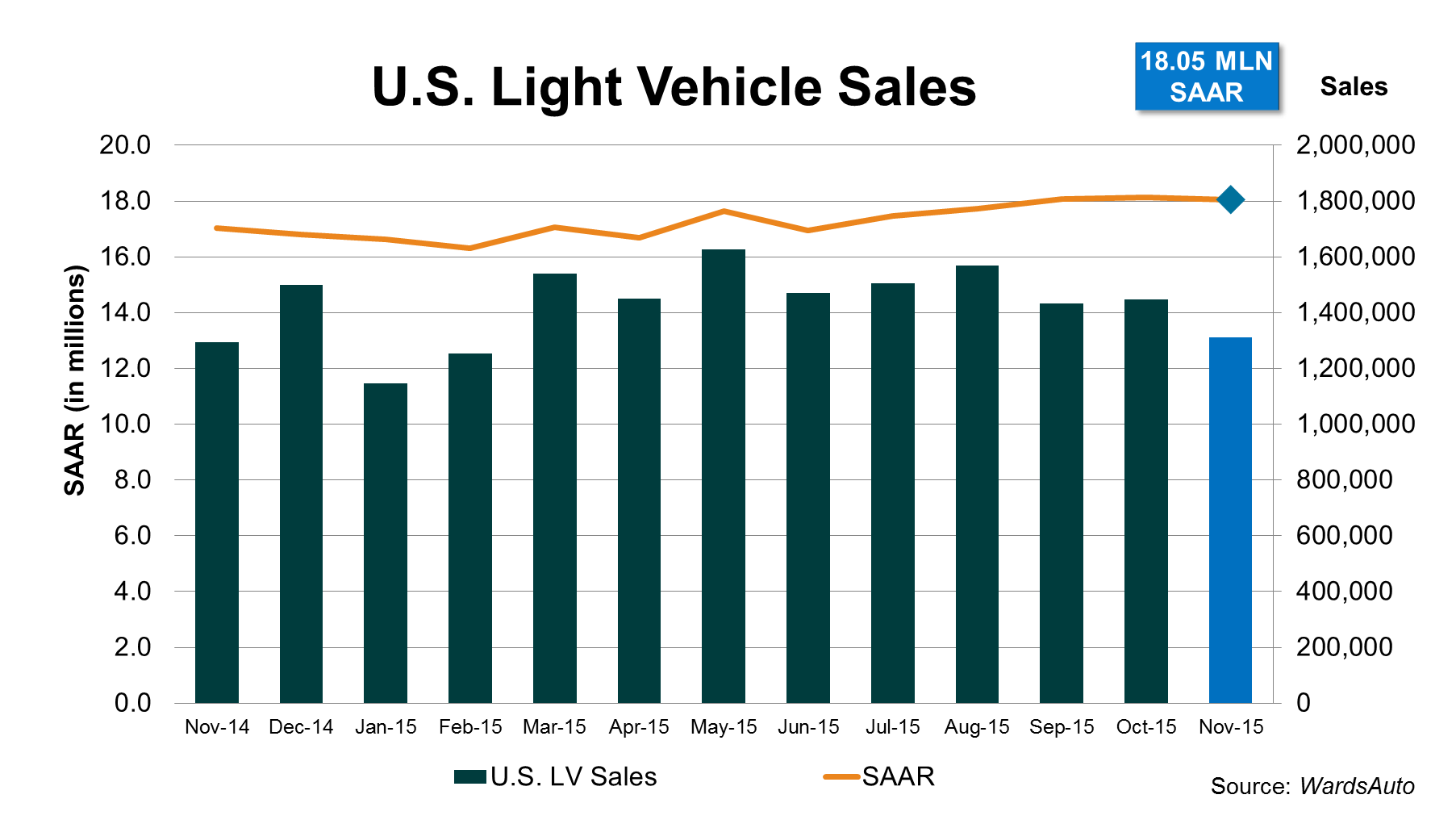

U.S. light-vehicle sales coasted to an unprecedented third straight month above an 18 million-unit seasonally adjusted annual rate in November.

Higher incentives, low-interest financing, good lease deals and holiday-related marketing all contributed to November’s 18.1 million SAAR, the same total as October and September. Strong fleet deliveries, based on initial estimates from third-party sources, also helped, but core consumer demand is at the heart of the boom, and entire-2015 likely will top the current high of 17.35 million units set in 2000, only to be outdone again in 2016.

For December to reach an 18 million SAAR, volume will have to hit about 1.7 million units, a level reached on only four other occasions, and always with extremely generous incentive packages in play – the record high is 1.804 million units in July 2005. However, consumer enthusiasm appears to be carrying into December, and the period has an atypical extra day in January to be included in its results.

November’s volume totaled 1.316 million units for a daily rate of 57,204 over the month’s 23 selling days, 10.5% above like-2014’s 51,776 (25 days).

Year-to-date volume through November totaled 15.78 million, 5.5% above 11-month 2014’s 14.94 million. December’s total will have to reach 1.59 million units, equal to a 16.8 million SAAR, to top 2000.

Spurred by a 23.6% increase in CUVs, truck penetration rose to 59.7%, a November record, bringing the 11-month year-to-date share to 56.3%, also a record. But in actuality, every truck segment recorded a sales gain from November 2014 and only three did not increase market share over last year. Most car segments recorded gains over year-ago, though most were small increases, and only two, Middle and Upper Luxury Cars, increased share over year-ago.

However, among the major automakers, FCA US, Ford, General Motors and Volkswagen/Audi were the biggest drag on car deliveries. Automakers posting car increases, significantly in some cases, were Honda, Hyundai, Kia, Nissan and Toyota. Trucks lifted the Detroit Three, including all segments at FCA and GM. Ford’s SUVs, pickups and vans increased, but its CUV sales fell short of year-ago, largely attributed by the automaker to a lull in fleet deliveries for the high-volume Ford Escape. Still, Ford was the only competitor in the CUV group to post a loss.

Ford finally was able to take advantage of full availability of its new F-150 pickup as total F-Series sales climbed 19.9% from like-2014, leading the Large Pickup segment to an 9.2% gain despite declines by the GMC Sierra, Nissan Titan and Toyota Tundra. The Chevrolet Silverado and Ram pickup were up 14.3% and 9.2%, respectively.

November sales in the largest segment group, CUVs, increased 23.6% from year-ago and LV penetration of 31.8% marked the sixth straight any-month record for the vehicles. Year-to-date CUV share stands at 29.8%, compared with 26.9% a year ago.

In other truck segments, SUVs were up 11.4% in November, while the smaller volume Small and Large Vans and Small Pickups each posted strong double-digit gains.

Deliveries of large trucks, including luxury versions, increased 12.0% from same-month 2014, garnering 20.4% of the market, highest for November since 2008. A 39.7% increase in vans in addition to big gains for luxury CUVs and SUVs led the overall gain.

Overall, trucks increased 19.0% in November, while cars fell slightly thanks to a drop in the Middle Car segment group. Small Cars eked out a gain, and the Luxury and Large Car groups had stronger increases, but LV share for both dropped from like-2014.

Including an estimated 10% increase for Daimler which has delayed reporting its results by one day due to technical difficulties, only Volkswagen/Audi recorded a decline from year-ago, evidently due to fallout from its emissions-rigging scandal. However, the Audi brand itself reported a 9.1% increase over November 2014.