U.S. automakers should sell 1.22 million light vehicles in October, according to a new WardsAuto forecast.

The effect of a federal government shutdown in the middle of the month likely was offset to a large degree by increased fleet sales, resulting in projected daily deliveries of 45,137 units over 27 selling days. That would be a 7.9% improvement on year-ago (26 days) but an 8.4% decline from September (23 days).

The September-October comparisons are slightly better than recent trend, reflecting September volumes reduced by the inclusion of Labor Day weekend sales in the August reports.

Nonetheless, the forecast 15.4 million-unit SAAR for October is below the Q3 average of 15.7 million.

The lower October SAAR assumes a downturn in consumer sentiment for a good portion of the month, reflecting disappointing preliminary job reports and consumer and business anxiety related to the government shutdown.

Industry executives indicate the presumed lost sales will be made up quickly, but the WardsAuto forecast factors in a slower overall retail sales rate for the month.

However, reports of an uptick in fleet orders lifted the forecast closer to trend, with a particularly strong effect on projected Detroit Three sales.

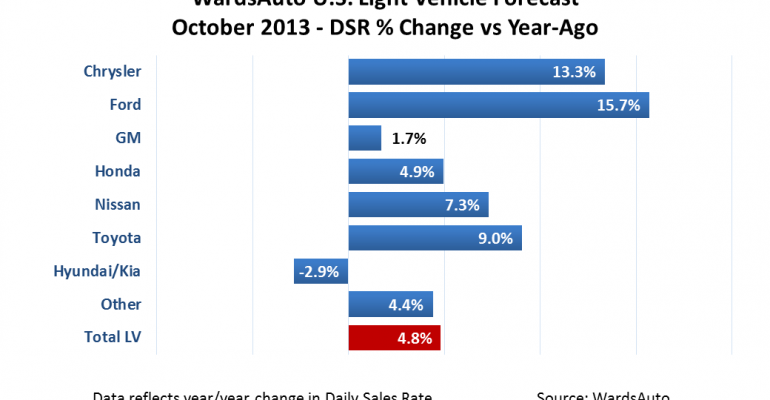

The WardsAuto forecast calls for General Motors to sell 207,000 cars and light trucks, accounting for 17% of October LV deliveries. GM’s projected daily sales rate represents a 1.7% improvement over year-ago, but a 5.9% drop from August.

Better fleet demand should help, with sales of GM’s all-new ’14 Chevy Silverado and GMC Sierra pickups tracking short of expectations in the early days after launching.

Ford’s forecasted 197,000 LV deliveries would be a 15.7% improvement over year-ago, giving the automaker a 16.2% share of the market – in line with last month.

Chrysler sales are expected to exceed 147,000 units, good for a 12.1% market share. Chrysler’s forecast DSR is 13.3% above year-ago but 11.4% below September.

Toyota is expected to account for 14.4% of monthly sales, with 176,000 deliveries representing a 9% improvement over its year-ago DSR.

Honda’s daily sales are expected to rise 5% over like-2012 for a 9.6% share on 117,000 deliveries.

South Korean automakers Hyundai and Kia should earn a combined market share of 7.7%, slightly above Nissan’s expected 7.3%.

The WardsAuto October forecast would bring year-to-date LV deliveries to 12.96 million units, up 8.4% from like-2012. WardsAuto currently is forecasting full-year 2013 LV sales of 15.6 million.