As the new year gets under way, automakers have begun fine-tuning their first-quarter production schedules, adjusting to control inventory in one area and boosting production to meet demand in another.

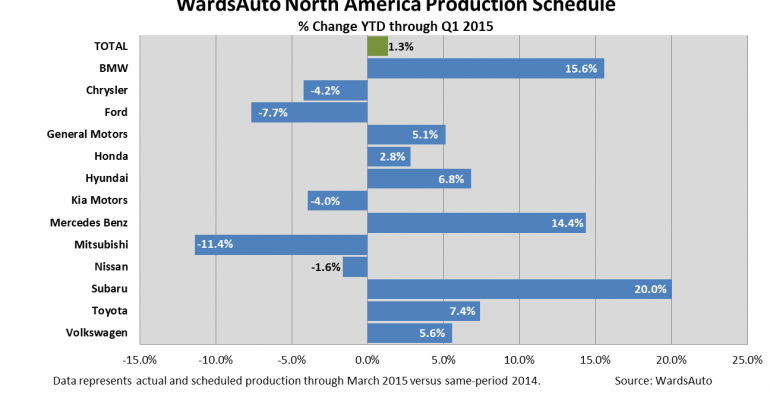

In total, the industry’s latest round of adjustments has resulted in the elimination of some 50,100 vehicles from the January-March slate, trimming it to 4,342,200 units, or 1.1% less than the 4,392,300 planned for the period a month ago. Compared with prior-year’s 4,286,500 assemblies, Q1 production still is slated for a 1.3% gain.

To be sure, light-truck output is being increased 13,800 units to 2,536,200 vehicles as producers move to meet burgeoning demand from consumers buoyed by sinking gasoline prices and a stronger economy. Compared with year-ago, truck production is up by 0.6%.

And that comes despite a nearly 3-month shutdown of FCA US’s (formerly Chrysler Group) Windsor, ON, Canada, van plant for model changeover and the ramping up of output of Ford’s all-new F-150 pickup.

Car plants, on the other hand, are seeing some significant cuts, reducing Q1 volume by 63,900 units to 1,806,000, although that still outpaces like-2014’s 1,765,000 completions by 2.3%.

Although Ford has yet to officially confirm its January-March production slate, it now is forecast by WardsAuto at 713,500 units, 7.7% below year-ago’s 772,800 assemblies. Ford is seen building 9.5% fewer trucks and 3.9% fewer cars.

FCA plans to build 4.2% fewer vehicles in Q1 than it turned out a year ago, thanks primarily to the lengthy van-plant shutdown. Car production, boosted by the popularity of the midsize Chrysler 200 and the smaller Dodge Dart, is 27.0% ahead of Q1 2014, despite a 15.4% cut in Fiat small-car output.

Booming demand is prompting General Motors to increase its January-March light-truck output 16.7% to 596,000 units from 510,800 a year earlier, while car production is off 12.7%.

The industry’s Q1 adjustments follow on the heels of a strong conclusion to 2014, with a preliminary October-December tally of 4,323,200 completions running 5.1% ahead of Q4 2013’s 4,112,000 units.

That was enough to end the year with a total volume of 17,411,400 vehicles, or 5.5% more than the 16,503,300 cars and trucks built the prior year

That made 2014 the third-best year in history, right behind the record 17,659,700 units assembled in 2000 and the 17,616,121 vehicles built in 1999.

The 2014 tally included a record 10,321,200 light- medium- and heavy-duty trucks that bested by 4.5% the prior benchmark of 9,876,893 units set in 2004.

However, car production reached only 7,090,100 units, 0.3% less than 2013’s 7,108,200 assemblies and ranked only 12th in the last 23 years.