U.S. automakers should sell 1.14 million light vehicles in September, according to a new WardsAuto forecast.

Pull-ahead sales from the Labor Day weekend, counted in the August sales report, are a large factor in the forecast, which calls for the monthly SAAR to fall to 15.3 million units just a month after breaking the 16 million-unit mark.

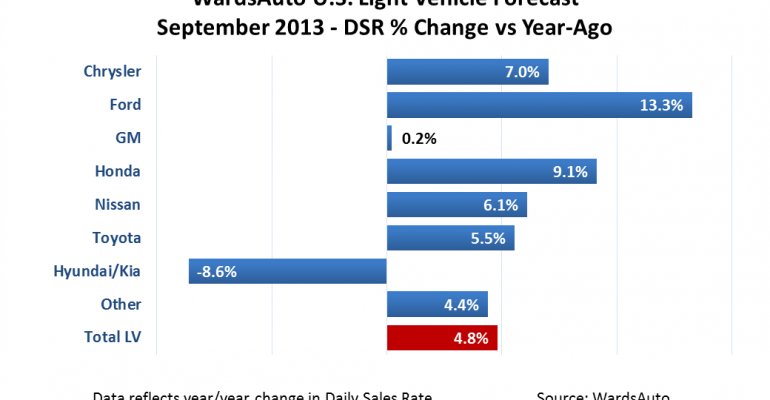

The projected 49,637-unit daily sales rate (over 23 selling days), a 4.8% improvement on year-ago (25 days), also represents a 7.3% decline from August (28 days).

But the August-September comparisons are muddied by the fairly unusual inclusion of Labor Day weekend sales in the August reports, which inflated the month’s DSR at the expense of September’s.

Taken together, however, August and September deliveries reflect a smoother trend line in the third quarter. The projected 15.7 million-unit SAAR for the 2-month period is identical, and shows steady growth over the 15.5 million SAAR for the second quarter.

Economic indicators point toward steady sales growth through the rest of the year, as well. Surveys by the Conference Board and Thomson Reuters/University of Michigan indicate slight declines in overall consumer sentiment and expectations for the future, but both surveys show an increase in consumers’ assessment of the present situation.

The U.S. Commerce Dept. reported August new residential construction was well ahead of year-ago but fell slightly on an annualized basis from July, while sales of single-family homes rose month-to-month and year-on-year.

The Bureau of Labor Statistics reports the economy added 169,000 non-farm jobs in August, leaving the unemployment rate unchanged at 7.3%.

U.S. automakers entered September with a 55-days’ supply of LVs, more than adequate inventory to meet the projected daily sales rate for most models.

Fleets, as a share of total LV sales, should rebound somewhat after two months of falling below seasonal expectations, but retail deliveries are expected to account for the bulk of September’s year-over-year growth.

The WardsAuto forecast calls for General Motors to sell 194,000 cars and light trucks, accounting for 17% of September LV sales. GM’s projected DSR represents a 0.2% improvement over year-ago, but a 14.5% drop from its August daily rate.

Reduced fleet sales, especially in the pickup segment, are the primary driver for the downward forecast.

GM is launching its all-new ’14 Chevy Silverado and GMC Sierra pickups with a focus on the higher end vehicles in the segment, and the attendant higher transaction prices. This strategy puts the automaker in an even more heated competition with segment leader Ford. The battle this month is expected to tilt heavily toward the Blue Oval.

Ford’s forecasted 178,000 LV deliveries would be a 13.3% improvement over year-ago, and gives the automaker a 15.6% share of the market – more than a full share-point higher than last month and prior-year.

Chrysler sales are expected to fall just shy of 140,000 units. Strong Jeep-brand light-truck deliveries should help lift the automaker’s DSR 7% over year-ago. The resulting 12.2% share would be Chrysler’s highest since February 2008.

Toyota, which crushed forecast expectations last month with 231,000 sales and a 15.5% share, should fall back toward trend in September with deliveries of 167,000 units and a 14.6% share.

Honda’s daily sales also are expected to decline from prior-month, with unit deliveries of about 118,000 vehicles accounting for 10.3% of the market.

The WardsAuto September forecast would bring year-to-date LV deliveries to 11.7 million units, up 8.2% from like-2012. WardsAuto currently is forecasting full-year 2013 LV sales of 15.6 million.