Strong sales expectations have prompted auto makers to adjust their record-level third-quarter North American output plans upward slightly.

That action comes a month after they reported unexpectedly strong production in the month of May.

The industry’s latest round of scheduling meetings has resulted in a July-September slate calling for 4,212,400 car and truck completions, 10,000 more than previously planned.

The third-quarter tally now is 6.5% higher than the 3,956,800 vehicles built in like- 2013.

A host of incremental adjustments are contained within the latest output plan that calls for culling 16,800 assemblies from August, while boosting the September slate by 26,000 units.

June remains virtually untouched, with just a net 800 units added to the charts.

Once again, truck output is being increased sharply, while car production is trimmed.

There are now 2,440,000 trucks slated for completion in the quarter, 34,300 more than had been planned a month ago, while 24,300 cars have been eliminated, for a revised total of 1,772,400 units.

Chrysler is at the forefront of the increased output, having boosted its July-September slate by 67,000 units, including 51,000 light trucks and 16,000 cars.

The auto maker is adding 64,500 assemblies, including 55,000 trucks to its July tally, while trimming the August plan by 14,500 units – including 16,000 trucks, an indication it sees a need to get more vehicles to dealers sooner than had been anticipated. Chrysler’s September slate stands 17,000 units higher than earlier panned, including 12,000 additional trucks

Ford is seen building 2,500 more vehicles in July-September, including 8,500 more trucks and 6,000 fewer cars than previously forecast, while General Motors overall third-quarter tally remains unchanged at 830,000 vehicles. However, GM is reallocating 10,500 assemblies from July to August (3,500) and September (7,000).

At the opposite end of the spectrum, Toyota has revised its third-quarter plan to build 15,500 fewer trucks and 10,000 fewer cars.

The industry’s July-September changes come on the heels of stronger than expected May close in which the final tally soared a whopping 78,700 vehicles above plan to 1,545,000 units.

That, coupled with a 6,300-unit upward adjustment in April, brought the second-quarter outlook to 4,493,700 units, 85,000 more than had been seen previously.

Although several manufacturers adjusted their June plans, the month’s net output total remains unchanged at 1,493,100 vehicles.

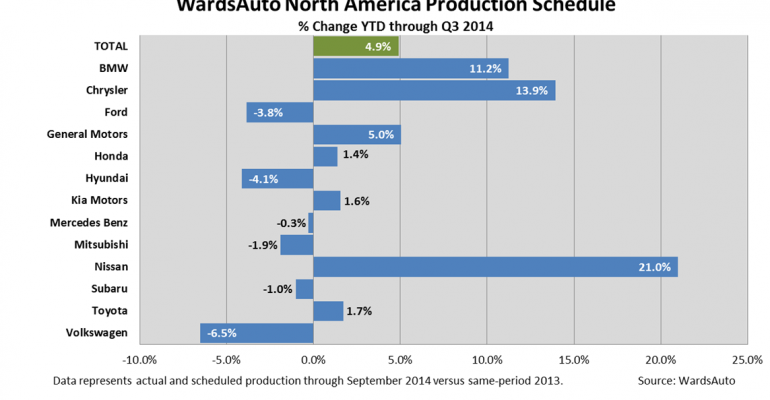

Output for the year through September now stands at 12,997,800 vehicles, 4.9% more than the 12,391,500 counted a year ago.

The Detroit Three are running at 104.2% of their prior-year output pace, transplants at 105.4% and dedicated medium- and heavy-duty truckmakers at 107.4%.