Superstorm Sandy, which analysts estimate cost the U.S. auto industry 30,000-60,000 light-vehicle sales in October, likely will have a positive effect on November deliveries, according to a WardsAuto forecast.

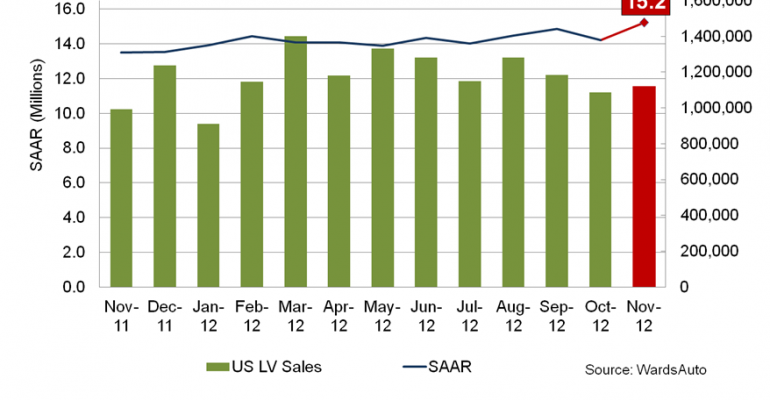

The outlook calls for auto makers to sell 1.12 million LVs this month, equating to a 15.2 million-unit seasonally adjusted annual rate, the highest since February 2008. WardsAuto had projected an October SAAR of 15 million prior to the devastation caused by Sandy, which resulted in severe flooding, power outages and widespread damage along the East Coast during the month’s final days.

In addition to delaying October sales, some of which are expected to be made up in November, the storm likely increased the overall demand for new vehicles. As many as 30,000 vehicles were destroyed by Sandy, creating an increased need and causing used-vehicle prices to rise. The shrinking price gap between new and used likely will move some used-vehicle customers into the new-car market.

The November outlook also is favored by the calendar. With Thanksgiving falling on the earliest date possible (Nov. 22), dealers not only enjoy the usual holiday-weekend traffic boost, but also have an entire week afterward to close deals during the month.

The November forecast volume represents a 13.1% improvement in the daily sales rate from year-ago (both months with 25 selling days) and a 7.3% increase from October (26 days).

The economic trends that informed WardsAuto’s earlier call for a 15 million-unit October SAAR continue to be positive indicators for the industry.

The national unemployment rate remained below 8% for a second consecutive month in October, as the economy added another 117,000 nonfarm jobs. The Conference Board Consumer Confidence Index, which increased nine points in September, rose another 3.8 points in October, while the board’s Present Situation Index leapt 7.5 points.

Additionally, October housing starts reached a new 4-year high, rising 42% over year-ago to an annualized rate of nearly 900,000, and analysts continue to cite recession-related pent-up demand for replacement vehicles as an upward force on sales.

The WardsAuto forecast looks for General Motors to sell 194,000 LVs, up 7.6% over year-ago and good for a 17.3% share of the November market. Ford should grab 15.2% of LV sales on a 3.9% boost in deliveries to 170,000, and Chrysler is projected to move 125,000 units, up 17.5%, for an 11.2% take.

Honda, benefiting from the launch of its all-new ’13 Accord and positive comparisons with stock-poor year-ago results, should improve monthly sales more than 33% over like-2011, with deliveries of 112,000 units accounting for 10% of LV sales.

Toyota sales should rise 16.8% to 161,000, equaling 14.4% of the market.

Nissan, on the strength of increased incentive spending, is forecast to maintain its year-ago DSR, achieved against a dearth of competition from inventory-starved Honda and Toyota. But its share will slip to just 7.6% of the market, compared with 8.6% last November.

Hyundai-Kia is expected to sell nearly 10,000 more vehicles than Nissan, for an 8.5% share, in line with its October market penetration.

The WardsAuto forecast would bring U.S. LV sales to 13,071,080 units through the first 11 months, up 13.7% from like-2011.

Despite Sandy’s deleterious effect on deliveries, the actual SAAR through October remained at 14.2 million units, still in line with WardsAuto expectations for full-year LV sales to reach 14.3 million to 14.4 million units.