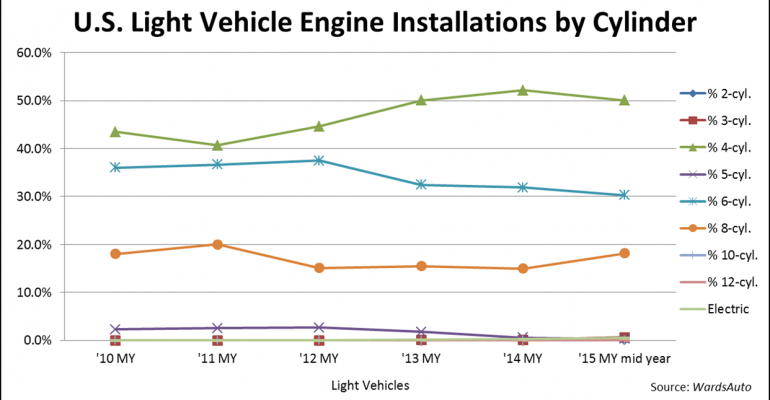

Thanks to resurgent demand for large pickups and SUVs, the installation rate of V-8 engines in U.S.-market light vehicles has risen to 18.2% midway through the ’15 model year, according to a WardsAuto survey, from 15.0% in the entire ’14-model run.

But engines with fewer than eight cylinders continue to rule the industry, thanks in part to a record 22.2% installation rate for so-called forced induction variants, those sporting turbochargers, superchargers or, for the first time, both.

At 21.6%, turbos by far account for a majority of “boosted” engines used in ’15 LVs compared with 20.6% of ’14 models. Thus, turbo use has grown by nearly 500% since ’10, when just 5.5% of gasoline and diesel engines were turbocharged. At a 5-year high, superchargers nevertheless, were used on a mere 0.6% of ’15-model engines, mostly in high-performance V-6 and V-8 applications, including a handful of engines combining a supercharger with a turbo for strong across-the-board throttle response.

At 21.6%, turbos by far account for a majority of “boosted” engines used in ’15 LVs compared with 20.6% of ’14 models. Thus, turbo use has grown by nearly 500% since ’10, when just 5.5% of gasoline and diesel engines were turbocharged. At a 5-year high, superchargers nevertheless, were used on a mere 0.6% of ’15-model engines, mostly in high-performance V-6 and V-8 applications, including a handful of engines combining a supercharger with a turbo for strong across-the-board throttle response.

Thanks in large part to the increased use of turbos, the 4-cyl. engine remains the most popular powerplant, driving 50.0% of ’15 LVs, according to the survey. That’s down only modestly from a modern-day record of 52.2% in ’14.

The “four” derives its leadership role from the car segment, where it powers 78.7% of ’15 models, besting the ’14 benchmark of 77.9%.

In light trucks, it has slipped to a 28.7% take rate this year from a record 31.7% in ’14, mostly the result of the V-8 surge, a wave that also slightly diminished the role of the V-6.

Overall, V-8 usage is at its highest LV level in four years, since a 20.0% rate was posted in model year ’11. It comes despite new inroads being made in the light-truck field by turbocharged gasoline and diesel engines and a continuing shift to engines with fewer than six cylinders in the car segment.

Also on the rise is the 3-cyl. engine, used in Ford, Mini and Mitsubishi cars.

Reappearing in the market after more than a decade’s absence, the I-3 made its comeback in the ’13 Mitsubishi Mirage with an added push in ’15 as the base engine for the iconic Mini Cooper as well as an option on Ford Fiesta.

In the course of three years usage in cars has increased to 1.5% from 0.1%, although its overall LV share remains at just 0.6% due the absence of any light-truck applications.

Another returning entry is the 2-cyl. engine, appearing on the charts for the first time since the early 1970s, when fledgling automotive upstart Honda used an air-cooled twin-cylinder engine to power its ’70-’72 N600 and sporty S600 microcars.

This time around, however, the 2-cyl. does not power an automobile directly, but to run an optional generator that extends the driving range of BMW’s all-new low-volume i3 electric car, thus I-2’s miniscule 0.1% car-market installation rate.

The 6-cyl.’s market share now is being nibbled away at both ends; by 3- and 4-cyl. powerplants on the one hand and by V-8s on the other.

Even with strong demand for Ford’s 3.5L EcoBoost engine and the introduction of FCA’s new turbodiesel V-6 in light-duty Ram pickups, LV 6-cyl. engine installations have slipped to 30.3% in the ’15 count from 31.9% in ’14, continuing a slide that began in ’13 when usage fell to 32.5% from 37.5% in ‘12.

The once-promising 5-cyl. engine appears now to be near death, succumbing to the shift to more compact and more powerful turbocharged 4-cyl. engines

At the same time, lower fuel prices have had a negative impact on hybrids so far in ’15.

The survey shows the fuel-efficient models account for just 2.1% of LVs tallied in the midyear count, a 3-year low that undercuts the 3.0% share garnered in ’14 and 3.5% in ’13. Included in the ’15 count are some 2,155 hybrids incorporating a turbocharged engine, the first such variants offered.

Electric vehicles account for an infinitesimal 0.5% of LVs this year, although that is nearly five times the 0.1% captured three year earlier. In cars alone, EVs account for 1.5% of the market, double prior-year’s 0.6% rate. There are no production EVs currently offered in the light-truck field.