LINTHE, Germany – How many automotive suppliers can design, manufacture and deliver a complete axle, 9-speed transmission, steering rack, suspension, brake calipers, electronic controllers, seatbelts and every airbag necessary to protect vehicle occupants?

Only one: Germany’s ZF Friedrichshafen, thanks to its recent $12.4 billion acquisition of TRW. Even Magna, which bolsters its position as arguably the world’s most diverse automotive parts producer with its purchase of transmission specialist Getrag for $1.9 billion, lacks ZF’s newfound technological breadth.

With estimated annual revenues of $30 billion, ZF now ranks behind only No.1 Bosch and No.2 Denso and sets out to leverage its bumper-to-bumper expertise as the industry, consumers and government regulators demand vehicles that are lighter, safer and more fuel-efficient, without compromising performance.

An engineer by trade, ZF CEO Stefan Sommer understands friction is the enemy in many aspects of product development, but he finds the term fitting when describing the integration of TRW, largely because there is virtually no overlap as the companies merge.

“We know friction is not good,” he tells journalists gathered here at a test track to experience the many competencies of the new entity. “But it’s rare. It’s gliding, it’s rolling.”

TRW will function as the fifth product division within ZF. In a matter of months, engineers and designers from ZF and the former TRW have been sharing notes, exchanging ideas and identifying best practices, and some of the resulting technologies will be ready for market in the near future.

“It’s what our engineering teams have realized in the shortest timeframe, and it demonstrates how great both technology positions are, coming from driveline, chassis, car safety and autonomous driving,” Sommer says. “They fit into each other. We try to show you our vision for the mobility of the future.”

With TRW’s vast experience with radar-based adaptive cruise control, lane-keeping and emergency braking, ZF suddenly is positioned to capitalize on the market for self-driving vehicles, should it take off.

Welcoming Era of Self-Driving Cars

At the media event here, ZF offers rides in an Opel Insignia wagon considered semi-autonomous for highway driving with only two forward-facing sensors, a camera near the rearview mirror (to identify lane markings) and radar behind the grille (to monitor traffic).

This latest-generation video camera, dubbed S-Cam3, has just launched for four major global vehicle platforms and can detect traffic lights, large animals and other objects while enabling automatic emergency braking, even for pedestrians at night.

More sensors could be deployed in the rear and sides of a vehicle to increase functionality, but the price also would rise.

“We are just making sure we do not drop off the lane that has been chosen, and we make sure we do not crash into traffic ahead,” Christoph Brezina, product development engineer coming from TRW, says from behind the wheel while demonstrating the Insignia on a public highway.

With no hands on the wheel or feet on the pedals, the car maintains the speed of the vehicle ahead. When the lead car slows down, so does the Insignia. When another car changes lanes just in front of the Insignia, it brakes automatically as the computer adapts and recalculates a safe trailing distance. Brezina has to do nothing but keep an eye on the road.

“Right now, it is rather simple and totally affordable to have this kind of functionality on a vehicle,” he says. “This makes this concept very attractive.”

On a recent day, Brezina worked five hours at his office in Düsseldorf and then got in the Insignia for a 311-mile (500-km) highway cruise, which took another five hours.

“Usually, I would expect to be extremely exhausted in the evening because I drove 500 km on a work day,” he says. “As it turned out, I wasn’t exhausted at all. This kind of traveling gets relaxed. You do not tend to speed, but you agree to flow with the traffic and just let it happen.”

But Brezina did not spend those five hours texting or reading a book. “I was sitting here watching traffic. It’s not extra time you gain for doing something else, but it is nevertheless relaxing, just like sitting on a sofa in your living room and doing nothing. You keep half an eye on the road and make sure everything works.”

Side-mounted sensors enable the next step toward automated lane changes, and Brezina says such testing is moving forward. “I indicate I want to change lanes, then the vehicle pulls over automatically” after ensuring there is no vehicle in the way or approaching, he says.

From Self-Drivers to Off-Roaders

Within the next two years, ZF, with the help of its TRW division, will launch key components for automated driving for a number of auto makers, says Andrew Whydell, who comes from TRW as director-product planning and global electronics.

Whydell says fully automated driving requires five pieces: sensors (radar or camera), a central data controller, software with algorithms to simulate the driving strategy, an easy-to-learn human-machine interface and actuators for braking, steering, engine and transmission.

“We have across the whole of ZF most or all of those building blocks so we can build a complete autonomous driving system, or we can provide combinations of those parts to automakers who are doing the integration themselves,” he says.

Also at the track here, ZF offers rides in two Volkswagen Passats equipped with automatic emergency braking and the ability to steer, without the driver ever touching the wheel, around a pedestrian who steps into traffic.

On a short off-road track, journalists got to experience several vehicles, including two that coincidentally showcase lots of ZF and TRW content: the BMW X5 and Mercedes GL CUVs.

Both vehicles have axles and chassis components from ZF, as well as brakes, seatbelts, airbags and electronics from the former TRW. The X5 also has ZF’s latest-generation 8-speed automatic transmission.

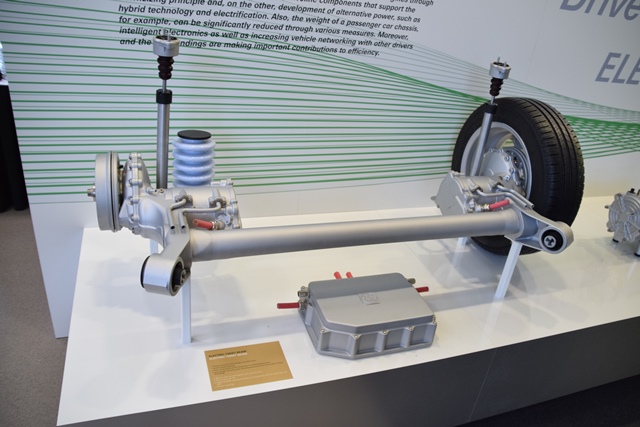

With its drivetrain expertise, ZF is gearing up for a future of electric vehicles by offering electric axle drives and the electric Twist Beam, which places an electric motor at each rear wheel.

The supplier developed several prototypes by purchasing front-wheel-drive Opel Agila subcompacts, yanking the gasoline engines and applying the power electronics and electrified axles, in various configurations.

Combine the electric twist beam with a third electric motor on the front axle, and the Agila delivers 922 lb.-ft. (1,250 Nm) of neck-snapping thrust, plus the bonus of torque vectoring to improve handling.

The new ZF is equipped to deliver a complete lightweight drivetrain for an EV, minus the battery.

Steering For the Future

Steering also is a long-time core competence for the new company. ZF had a joint venture for steering systems with Bosch but had to exit it, surrendering its share to Bosch because TRW is one of the top global players in the segment.

One of the Agila prototype EVs here, dubbed the Smart Urban Vehicle, is set up with a steering system that articulates the front wheels an astonishing 75 degrees, while most vehicles can only achieve about 60 degrees.

The result is a vehicle that nearly can turn on a dime, spinning on an axis while its rear inside tire barely rotates. The benefits are tremendous in congested cities where parking spaces are tight and scarce. With the proper electronics, the car can park itself.

Even without TRW, ZF made inroads with another type of chassis technology: steering the rear wheels. Using electric actuators, ZF’s Active Kinematics Control can turn the rear wheels up to 5 degrees in either direction, helping improve handling and maneuverability both at high and low speeds.

Porsche has the system as standard on four models of the 911, and the all-new Audi Q7 also uses it. Several more customers are expected to roll out the system within the next year.

To illustrate the extreme capabilities of 4-wheel steering, ZF and TRW equipped a prototype BMW 5-Series sedan with two steering wheels, the usual one for the front wheels and another on the passenger side to steer the rear.

The effect is a car that moves like a caterpillar, its back end able to rotate widely around a corner if turned in the opposite direction as the front wheels.

As the two companies come together, the mood among former TRW employees is “one of excitement and anticipation,” says Peter Lake, who was executive vice president in charge of sales at TRW and will join the ZF board of management in October.

“People see there is a vision and a great opportunity for this company going forward,” Lake says. “Inevitably there is some apprehension, because people can’t be 100% certain while you’re going through some level of change. But I think there is really some comfort around that is not common in such mergers.”

He admits he has to “ramp up pretty quickly” his knowledge of ZF products such as axles and transmissions. “Certainly for me personally, it will be a challenge to understand the breadth of this new company,” Lake says. “It’s a tremendously wide product portfolio.”