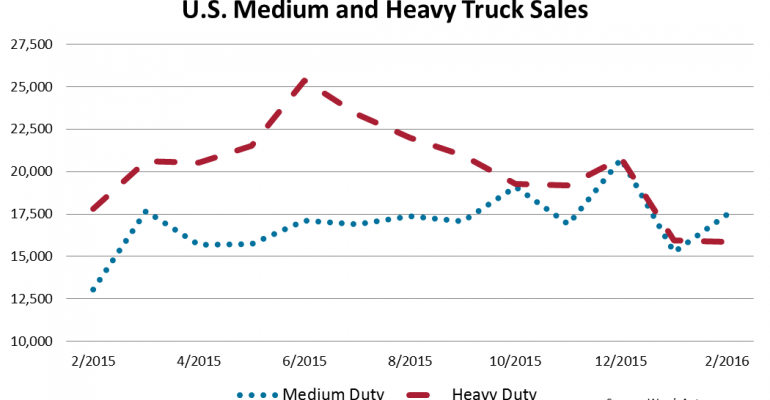

U.S. sales of medium- and heavy-duty trucks in February rose 8.0% from year-ago, reaching 33,353 units, a 9-year high for the month, WardsAuto data shows.

Heavy-duty trucks took a sharp downturn, while every medium-duty class showed a double-digit gain.

Class 8 sales totaled 15,876, down 10.9%. The only brands with positive results were Mack (+4.0%) and Western Star (+11.4%), but declines by their sister brands left the parent companies’ totals below prior-year. The greatest loss came from International, falling 21.2%. Year-to-date, the group was down 9.6%.

Medium-duty deliveries were 33.9% above year-ago, totaling 17,477. Over the first two months of the year, sales were up 24.2%.

Class 7 had the smallest gain with a 13.0% jump to 4,201 trucks. The group leader, Freightliner, recorded a 30.4% spike. Peterbilt’s sales rose 38.2%, dampened by a 2.2% dip from Kenworth, resulting in a 19.7% rise for PACCAR. Ford posted a 53.5% drop to 128 units.

Class 6 deliveries reached 5,885 vehicles in February, 40.0% better than like-2015, as all brands surpassed last year’s tally. The biggest growth came from PACCAR’s Kenworth and Peterbilt brands, up 87.8% and 66.7%, respectively, but on relatively small volume. Ford boosted sales 53.3%, increasing share to 28.1%. Top-selling Freightliner showed a 36.7% sales gain.

Class 5 hit a best-ever February result of 6,386 units, a 48.8% leap from prior-year. Freightliner (+241.4), FCA (+116.2%) and Hino (+145.6) posted triple-digit gains. Class leader Ford sold 3,817 trucks in this group, up 29.4%.

Class 4 sales rose 20.5% to 1,005 units. Ford saw deliveries drop 7.8%, and Mitsubishi Fuso slipped 67.7%. Isuzu recorded a 36.3% gain by its domestic models and a 35.1% rise for imports.

Medium-duty inventory sat at 57,791 units at the end of February, equating to a 79-day supply, lower than the 88 days from year-ago. The month ended with 52,200 heavy trucks in stock, also a 79-day supply, but up significantly from the 58 days from like-2015.

In other big-truck news, the Cass Freight Index Report found the number of North American freight shipments in February shot up 8.3% from January, erasing January’s decline, while expenditures for freight shipments gained 6.3%, not quite overcoming January’s drop. The strong growth in freight in February was an expected trend, but the recent 4-month slide in freight traffic put the starting point for 2016 significantly lower than in the last several years.

Fuel prices remained low in February. The national average gas price was $1.872 per gallon, below $2 for the first time in seven years. Diesel prices also slipped below $2 to $1.998, the lowest price since January 2005.