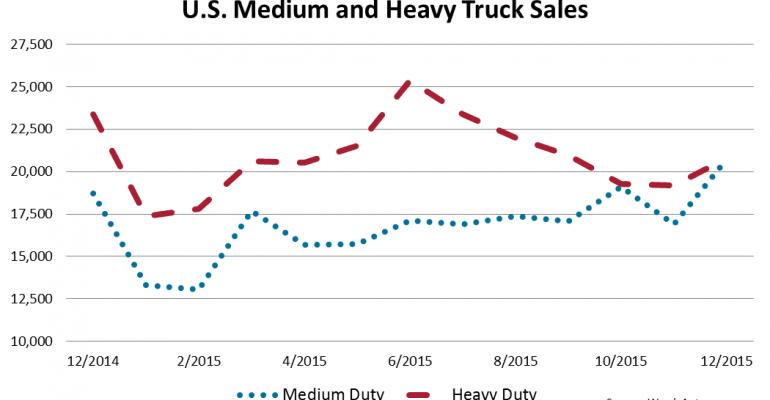

U.S. sales of medium- and heavy-duty trucks in December slipped 8.5% from like-2014 to 41,508 units. Despite this decline, full-year 2015 finished at a 9-year high. The 449,458 tally was 10.5% above 2014.

Class 8 showed the sharpest downturn of the weight groups in December, falling 17.5% on sales of 20,773 units vs. 23,379 year-ago. Nearly all manufacturers posted double-digit declines, except for Volvo Truck, as the Volvo brand’s 7.6% growth counteracted a 22.8% drop by Mack. Group leader Freightliner was down 22.4%, and its sister brand, Western Star, fell 17.2%. PACCAR’s Kenworth and Peterbilt posted drops of 22.7% and 22.3%, respectively. Although Class 8 results were poor in December, the 12-month total was 12.9% above year-ago, reaching 248,804.

Class 7 posted a 9.1% decline on unit sales of 5,188 against 5,297 in December 2014. Peterbilt was the lone bright spot in the segment, up 17.8%. Kenworth showed a 19.1% drop, thus bringing PACCAR’s total down 1.9%. Sales were mostly flat for Freightliner, ticking up just 0.1% to 2,322 units. Year-to-date, Class 7 performed 8.7% better than 2014, with 58,888 trucks delivered.

Class 6 was up 0.2% from same-month 2014, with 5,109 units. Results among brands were split, with each showing a double-digit gain or loss. On the positive side were Ford (+26.5%) and Kenworth (+75.5%). Freightliner (-27.9%), Hino (-11.6%), International (-10.1%) and Peterbilt (-25.0%) slowed the segment’s growth. The January-December total of 55,118 was 6.6% better than the previous year.

Class 5 saw the biggest bump in December, up 14.0% to 8,738 deliveries. Ford, the top seller in the group, posted a 30.2% spike. Freightliner also grew, up 86.9%. However, FCA (-14.3%) and International (-54.8%) negated some of that growth. The 12-month tally came to 72,286 units, 7.8% above like-2014 and a record high.

Class 4 was down 0.3% with 1,700 units sold. Isuzu domestic trucks were down 11.3%, while its imported models inched up 1.2%. Ford sales shot up 30.9%, while Mitsubishi Fuso slipped 40.2%. Full-year 2015 sales in this group rose 7.4% to 14,362 trucks.

December finished with a 70-day supply of Class 8 trucks, much higher than the 43 days from same-month 2014. Stock of medium-duty trucks also was up from prior-year with a 72-day supply.

In other big-truck news: The Cass Freight Index Report for December 2015 showed a 3.7% drop in shipments and a 5.2% decline in freight expenditures compared with same-month 2014.

Also, FTR released preliminary data showing December 2015 North American Class 8 truck net orders at 27,800 units. Their calculations show the average number of orders in November and December was close to that of the previous ten months and the year finished at 284,000 units.