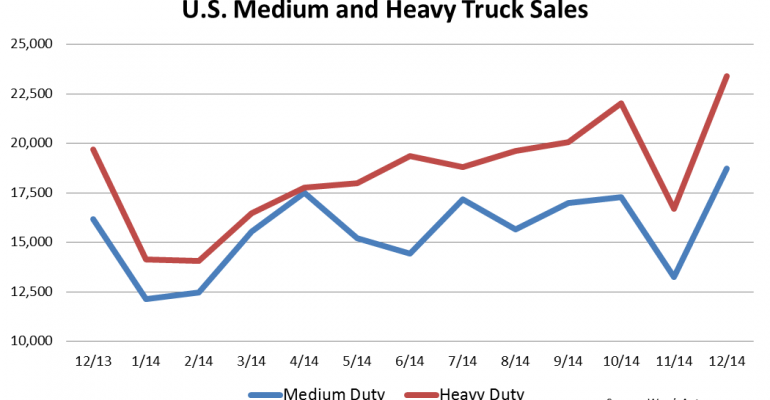

U.S. sales of medium- and heavy-duty trucks rose 12.9% in December to 42,110 units, lifting full-year 2014 results to an 8-year high.

Big truck makers sold 406,747 units for the year, a 15.6% increase over 2013 and the highest level since 2006 when deliveries totaled 544,581,WardsAuto data shows.

Class 8 deliveries jumped 14.1% in December on sales of 23,379 units vs. 19,695 year-ago. All manufacturers enjoyed double-digit gains, except for International, down a slight 0.8%. Daimler’s Western Star led all gainers, surging 88.2%, while Freightliner reported a 17.0% gain, raising overall Daimler sales 20.3%. Mack was up 16.6% while PACCAR’s Kenworth and Peterbilt brands posted gains of 11.7% and 13.2%, respectively. Full-year 2014 Class 8 deliveries reached 220,405 units, the highest tally since 2006’s record year and the fourth-best performance on record.

Class 7 posted a 19.2% rise on unit sales of 5,297 against 4,272 in prior-period. Hino led the group, surging 52.5% on sales of 360 units while Ford was second-best, rising 41.0%. Peterbilt suffered the only loss in the segment, slipping 8.0% on volume of 511 units.

Class 6 also posted double-digit gains for the month, climbing 14.7% on 4,733 units. For the second month in a row, Peterbilt (+127.3%) posted a triple-digit gain while Kenworth was up 24.4%. Market leader Ford was the only brand to suffer a loss in the segment, falling 7.6% and resulting in a decline of more than eight percentage points, from 43.6% last year to 35.1%.

In Class 5, a 176.7% spike in Hino sales along with FCA’s 54.2% uptick was enough to lead the segment to a 5.6% December increase, overcoming losses by all other OEMs. Mitsubishi Fuso fell 42.5%, while Freightliner was down 38.7%. Segment leader Ford slipped 5.2% and saw its share sink to 53.5%.

Class 4 was up 5.8% with 1,584 units sold. Isuzu domestic trucks were up 26.6% while its import models inched up 6.4%. Ford sales slid 24.3% while International slipped 3.8%.

Class 8 inventory fell for the first time since June, but still was 8,000 units ahead of last year to 38,708 from 30,194 year-ago. December days’ supply was 43, up from 38 in like-2013. Medium-duty truck makers ended the month with 45,834 units in inventory, the lowest level since March and a 64-day supply. That compared with 40,361 and 62 days’ in like-2013.

In other big-truck news: FTR releases preliminary data showing December 2014 North American Class 8 truck net orders at 43,620, the third consecutive month above the 40,000 level. December’s order strength, unlike the previous two months, was broad-based among OEMs, with almost all manufacturers showing healthy increases from the previous month indicating an overall vibrant truck market.