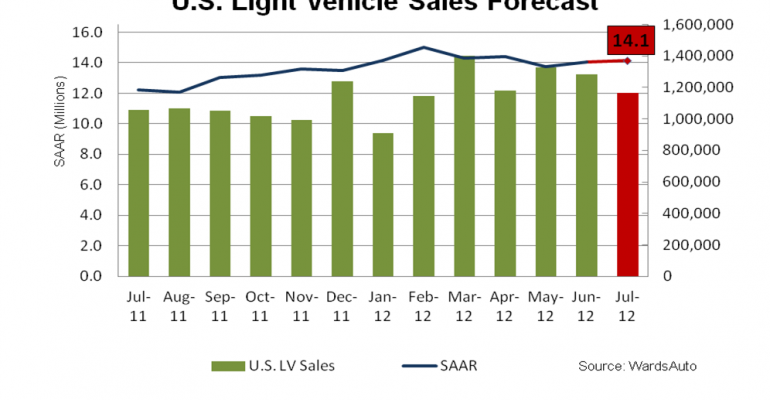

Auto makers are expected to deliver 1,168,000 cars and light trucks in July, driving the daily sales rate up 19.7%, compared with year-ago, according to a WardsAuto forecast.

Amid lackluster economic reports, some positive signs for the auto industry indicate steady sales throughout the summer months. Among them, housing starts were up 6.9% in June, and there are indications existing home prices have bottomed out and are beginning to rise as investors return to the market.

A survey of homebuilders by the International Strategy & Investment market-research firm and another by the National Association of Home Builders also show growing confidence within the housing industry.

And even though consumer confidence, as measured by the Conference Board monthly surveys, dipped slightly in recent months, the U.S. Commerce Dept. reports retail spending was up nearly 4% in June. And The Wall Street Journal cites a recent retail survey that projects back-to-school spending will rise 14% this year.

The June unemployment was 8.2%, according to the Bureau of Labor Statistics, directly in line with the average monthly rate for the year’s first half. So while employment figures aren’t getting better, they are not getting worse. And people who have jobs apparently are more willing to spend money.

However, the key economic indicator for auto sales is…auto sales.

Since the end of the recession, the industry recovery has run ahead of, and is largely independent of, the pace of the overall economic recovery. With the average age of registered vehicles reaching an all-time high, retail and fleet customers are looking to replace older vehicles as soon as they can afford to do so.

The need to meet pent-up demand has kept the sales rate remarkably consistent during the year’s first half. The seasonally adjusted annual rate of LV deliveries for the first six months was 14.2 million units, with June sales registering a 14.05 million monthly SAAR.

With little indication that July deliveries will veer dramatically from trend, the WardsAuto forecast for July equates to a 14.1 million-unit SAAR. (Note: BEA factors normally used to calculate monthly SAARs are not yet available for July. The July SAAR is calculated using WardsAuto’s estimated factors.)

At forecast levels, July’s daily sales rate over 24 selling days is 48,652 units, up 2.5% over June’s DSR (27 days) and up 19.7% from year-ago (26 days). July deliveries in 2011 were hampered by depleted inventories resulting from the Japan’s earthquake and tsunami earlier in the year that disrupted global auto production for months.

The WardsAuto forecast calls for the Detroit Three to account for 45.1% of July sales, with General Motors taking a 19.9% market share with 232,000 units.

Ford should remain in the No.2 spot with a 15% share on 173,000 deliveries. Chrysler’s DSR should rise 17.5% over year-ago, accounting for 10.3% of July sales with 121,000 units. Combined daily sales for the Detroit Three are forecast to grow 13% compared with year-ago.

The Detroit auto makers traditionally see fleet sales diminish in July, but the WardsAuto forecast expects the June-to-July mix shift to be less pronounced this year, with GM, Ford and Chrysler enjoying sizable fleet volumes, particularly with light trucks, in addition to relatively robust retail sales.

Indeed, the ’12 model selloff that began in June should continue to boost retail sales, as most auto makers make room for the coming ’13 models with increased advertising and incentive spending.

Toyota, after several months of better-than-average participation in fleet deliveries, will see sales fall below trend in the months leading up to its new-model introductions, but improving retail sales will offset some of the fleet decline.

The WardsAuto forecast calls for Toyota to sell 164,000 LVs in July, lifting its DSR 25% over an inventory-depressed year-ago. Honda, which took an even harder hit to its global production last year, is expected to lift its daily sales more than 44% to 116,00 units.

Hyundai Group should grab 8.8% of all LV sales in July, with 103,000 deliveries of Hyundai and Kia brand vehicles. The forecast also calls for Nissan to push its share from 7.2% in June to 8.3% on the strength of 97,000 units.

Projected U.S. LV sales for July would bring the year-to-date total to 8.42 million units, up 14.25% from like-2011.