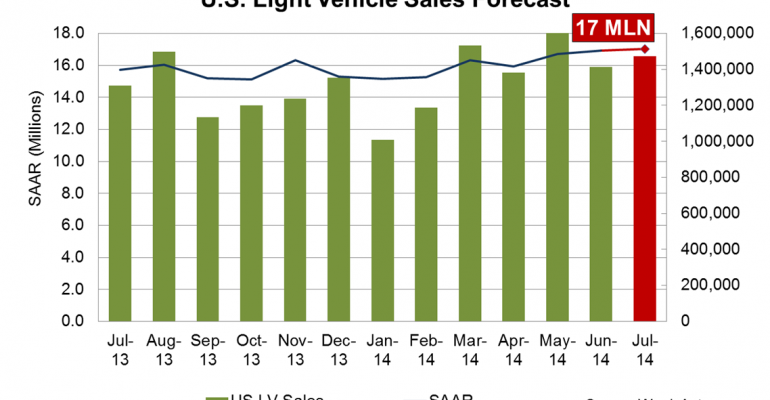

A new WardsAuto forecast calls for U.S. light-vehicle sales to continue to gain ground on year-ago, while lifting the seasonally adjusted annual rate (SAAR) of sales to an 8-year high.

The report calls for 1.47 million LV deliveries this month, equating to a daily sales rate of 56,678 units (over 26 days), a 3.9% dip from prior-month (24 days) but an 8.2% improvement over same-month year-ago (25 days).

The projected 17 million-unit SAAR would be the highest since July 2006, just above June’s 95-month-high 16.9 million SAAR.

There’s also some reason to believe LV sales will outpace the forecast. The projected 3.9% DSR decrease from prior-month would be the biggest June-to-July dip since 2008, when rising gas prices and small-vehicle inventory shortages spurred a dramatic drop in deliveries.

Early July reports indicate retail deliveries are at the heart of the current sales surge, which is being fueled by low interest rates, steady incentives and continued recession-related pent-up demand.

Consumer confidence in June, as measured by the Conference Board Consumer Confidence Index, was at its highest level since January 2008. A Bloomberg survey, meanwhile, indicates that employers added 230,000 jobs in July, maintaining a 6.1% unemployment rate.

Inventory continues to be a strong point for the industry, with June’s healthy 59 days’ supply projected to continue to the end of July.

The WardsAuto forecast calls for Detroit Three daily sales to climb 10.6% over year-ago – leading all regions in year-over-year gains for the month – while accounting for 44% of industry LV volume compared with 43% for the same-month year-ago.

General Motors is expected to sell 268,000 LVs, a 10.4% gain in DSR reflecting strong light-truck sales. GM’s 18.2% projected market share compares favorably with the company’s 17.9% year-ago take.

Ford should eke out a 14%-plus share in July, with deliveries in the neighborhood of 208,000 on a DSR bump of 5.6%, but likely will fall to third place behind Toyota for the first time since August 2013.

Slowing F-Series sales, due to fewer incentives and diminishing inventory, play a key role in the report’s expectations for the automaker.

Chrysler’s projected 18.4% DSR gain – equating to 170,000 deliveries and an 11.6% share – would be its largest year-over-year gain since July 2012.

Asian automakers’ collective DSR is forecast to rise 7% over year-ago, on LV deliveries of just under 700,000 units – good for a 47.2% share.

WardsAuto’s forecast calls for Toyota to claim 14.8% of LV sales with nearly 218,000 deliveries – a DSR gain of 8.2% that would leave the Japanese automaker in the No. 2 sales position for the month.

The WardsAuto report calls for Honda daily sales to fall 3.2%, with 142,000 deliveries, accounting for 9.7% of the LV market.

The forecast also calls for Hyundai-Kia to finish neck-and-neck with rival Nissan this month, with both automakers taking 8.7% of the market on 128,000 deliveries each.

Daily sales by European automakers are expected to rise 3.2% compared with same-month 2013.

Audi is expected to lead all automakers in year-over-year improvement with a forecast 26.5% leap in daily sales, while sister German brand Volkswagen is forecast to lead all companies in year-over-year decline, with a projected 19.2% drop in daily sales.

At forecast levels, year-to-date sales through July would rise to 9.6 million units, up 5.4% over same-period 2013.