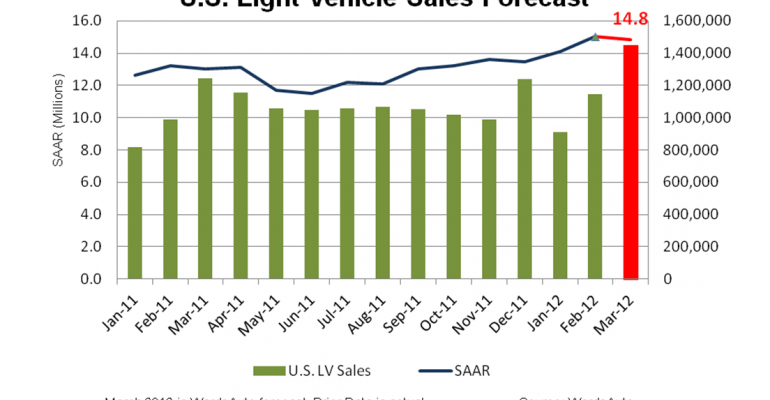

U.S. auto makers should sell more light vehicles in March than in any month since July 2007, according to a WardsAuto forecast.

The forecast calls for 1.45 million LV deliveries, or a 51,700-unit daily sales rate over 28 selling days (including sales through April 2), representing a 12.4% increase over year-ago’s 27 days and a 12.8% rise from February, with 25 days.

At forecast levels, the March seasonally adjusted annual rate would be 14.8 million units, just below February’s 4-year-high SAAR of 15 million units, and would bring the first-quarter SAAR to 14.7 million units – well above most analysts’ early outlook for 2012.

Whether February’s and January’s SAARs were above-trend aberrations (January’s annualized rate was 14.3 million) has been a topic of discussion among industry observers, but WardsAuto analysis shows little reason to expect a near-term loss of momentum.

February sales were backed by healthy incentive spending, including high rebates on some of the market’s most popular vehicles. However, total incentive spending was down from prior-year’s aggressive industry-wide splurge, indicating the current sales spike is more organic than year-ago’s Q1 sales bump.

Concerns about rising gas prices, already averaging more than $4 a gallon for a third of U.S. drivers according to recent reports, appear to be pushing consumers toward more fuel-efficient vehicles, as illustrated by the industry’s two successive record-high ratings on the WardsAuto Fuel Efficiency Index in January and February.

However, there doesn’t appear to be any evidence that fuel prices are hurting the overall market volume. And some analysts have posited that higher gas prices may be bringing customers into the market in search of more fuel-efficient new vehicles.

Further, the Conference Board Consumer Confidence Indexreleased at the end of February showed a marked increase in both long- and short-term confidence in the economy.

A subsequent federal government report shows employers adding some 227,000 jobs in February, contributing to overall expectations that consumer sentiment will remain positive through March.

While fleet sales have played a fairly robust role in recent market activity, their penetration does not appear to be significantly out of sync with historical Q1 rates, nor do they seem unsustainable for the short term based on past performance.

Indeed, while General Motors and Ford have been reporting fairly high fleet sales in 2012, WardsAuto expects the two auto makers to increase their March DSR from February’s by 6% and 12%, respectively.

GM’s daily rate could improve as much as 16% over year-ago, accounting for 17% of March sales, on deliveries of a quarter-million LVs.

The high year-over-year growth is attributable in part to GM’s poor performance last March, caused by pull-ahead sales the prior two months spurred by the auto maker’s atypical incentive spend.

Ford is expected to deliver 220,000 LVs this month, grabbing 15.3% of the market and improving its DSR 2% over its high fleet-sales induced year-ago results. Chrysler’s expected 156,800-unit deliveries would represent a nearly 25% gain on year-ago.

Adding to WardsAuto optimism is the relatively bright outlook for North America that OEMs are signifying with their ongoing production buildup. The current slate calls for first-half output of more than 8 million vehicles, a 20.8% increase over prior-year.

Toyota and Honda, eager to make up sales lost in 2011 due to Japan’s tsunami-related inventory shortages, have pushed production in the first two months of this year. The auto makers’ positive February results, corresponding with much-improved inventories, should continue into the second quarter.

Toyota’s aggressive March financing program, announced on the first sales day of the month, appears to speak to the company’s intent to recapture market share in the year’s first half. WardsAuto looks for the auto maker to have its first 200,000-unit month since the height of the Cash-for-Clunkers rebate program in August 2009.

Honda and Nissan are expected to finish March in a dead heat, with some 140,000 deliveries and 9.7% of the market apiece, while the combined European brands should account for roughly 9% of sales.

Forecast deliveries would lift year-to-date LV sales to 3.5 million units, for a 14.5% gain on year-ago.