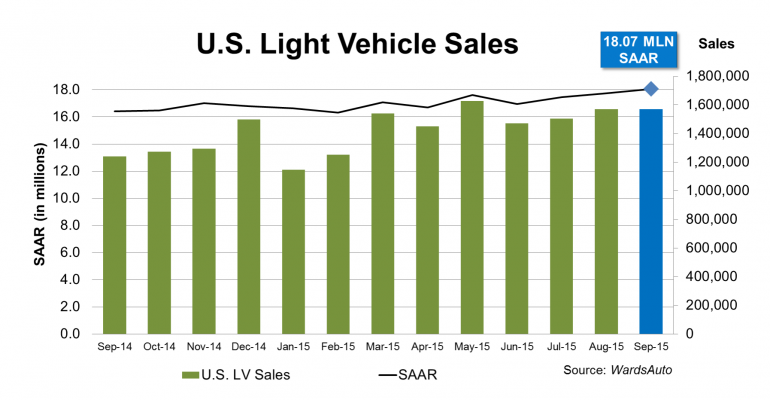

U.S. light-vehicle sales equaled or surpassed an 18 million-unit seasonally adjusted annual rate for only the 10th time ever in September and the first time in 10 years.

Volume surged 16% above September year-ago in part due to the longer length of the reporting period this year because the Labor Day weekend last year was included in August’s results.

Based on daily selling rates – 25 days vs. 24 in like-2014 – September’s sales increased 11.2%: 57,404 vs. like-2014’s 51,603.

September’s SAAR, which takes into account changes in selling days, increased 10% from same-month year-ago to 18.1 million units. The year-to-date SAAR through September is 17.2 million, compared with 9-month 2014’s 16.4 million.

The SAAR also marks the third straight month-to-month increase, a rarity even during stretches of strong growth, which, along with the subsequent drain on already lean inventory, likely indicates a downward sales payback in October.

The July-September sales surge, with the SAAR averaging 17.7 million units, carved out a large chunk of older model-year inventory that left dealers with a bigger-than-usual mix in stock of new-model vehicles – most with increased prices.

CUVs continued an upward path. September sales were 28.3% above year-ago, and market share of 31.3% was the fourth straight month the segment group attained an all-time record.

The CUV juggernaut, with help from midsize SUVs, small pickups and fullsize vans, pushed total truck sales to 58.3% of the market, a record for September.

Unlike August, when every car segment group posted year-over-year declines, the Small and Middle Car sectors recorded gains in September from year-ago, but market penetration for both still declined from year-ago. Also, there likely were some increased incentives or fleet activity boosting volumes in those groups.

Reversing a recent trend, sales of domestically produced LVs had better year-over-year gains in September than overseas-built vehicles. Domestic sales increased 11.6% from year-ago, and penetration rose to 79.3% from 79.0% in same-month 2014.

Sales of imports increased 9.8% in September.

Year-to-date sales of locally sourced LVs through last month were up 5.4%, compared with a 3.9% gain in imports.

Nearly every automaker posted a year-over-year increase in September, with market-share gains recorded by Ford, Jaguar-Land Rover, Kia, Mitsubishi, Nissan, Porsche, Subaru, Toyota and Volvo. Hit with sales declines were BMW and Tesla.

Sales by Volkswagen/Audi, which are being scrutinized closely due to last month’s emissions-cheating revelation, increased 2% from year-ago in September.

Because VW’s sales already were tracking below year-ago heading into the month, September’s rise indicates the scandal has not had much effect yet. However, the Volkswagen brand was down 3.5%, while the Audi luxury-brand increased 11.6%. Although an Audi vehicle is included in the deception, the brand might not be closely identified with Volkswagen by many consumers and could be somewhat immune to negative implications from the scandal.