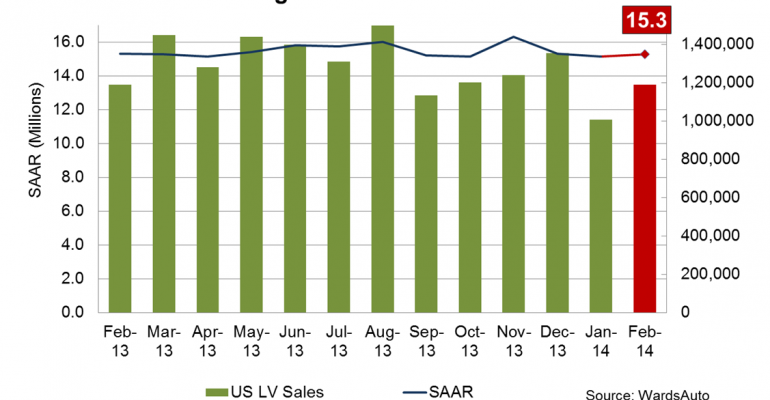

Cold weather and expectations of continued slow fleet sales factor into a new WardsAuto forecast that indicates a third straight month of below trend U.S. light-vehicle sales.

The report calls for U.S. automakers to sell 1.19 million LVs this month (over 24 selling days), a 0.1% decline over same-month year-ago (24 days).

The projected 15.3 million-unit SAAR would best January’s 15.3 million rate, but fall shy of the current rolling 6-month SAAR of 15.6 million.

The cold weather that automakers blamed for January’s lower-than-anticipated sales tally stretched into the beginning of February. A mid-month respite sparked some enthusiasm for a strong finish to the month, but current projections call for a return of unusually cold weather across the East, Midwest and large parts of the South during the all-important final week of sales.

With weather holding retail deliveries in check, automakers are unlikely to get much relief from fleet sales, as a slowdown in commercial and rental orders, which first manifested in fourth quarter 2013, is not expected to let up.

However, if extreme winter weather is indeed the key factor in hampering early 2014 sales, the industry should expect pent-up demand to fuel a sales spike in March or April, similar to the post-government-shutdown bump that sent November’s SAAR rocketing to 16.3 million.

Even stuck at year-ago levels, February’s projected daily sales rate represents a 23% improvement over January’s DSR (over 25 days). That, coupled with lower-than-forecast production (partially weather-related, as well), should poke a hole in the supply bubble that emerged last month.

Inventory, which ballooned to an 89 days’ supply at the end of January, is projected to fall to 73 days’ by the end of the month.

The WardsAuto forecast calls for Detroit Three sales to drop 2.7% below year ago, to 540,000, and a combined 45.5% market share, vs. 46.7% of year-ago sales.

Both Ford and General Motors are expected to underperform year-ago. GM deliveries are forecast to fall 9.5%, with 203,000 LV sales accounting for 17.1% of the market. Ford is forecast at 4.5% below year-ago, with deliveries falling to 183,000, for a projected 15.4% sales share.

The report calls for Chrysler to improve 11% from year-ago levels, with 153,000 deliveries giving the automaker nearly 13% of February sales.

Asian automakers are expected to have the best year-over-year results, rising 3.5% to 547,000 deliveries and a 46% market share. However, Toyota, the group’s volume-leader, is forecast slightly below year-ago, with 162,000 February deliveries and a 13.7% share. Subaru again is expected to show the fastest growth among all automakers, with a projected year-over-year rise of 31.4% on 37,000 deliveries.

Nissan is forecast to outsell rival Honda for the first time since March.

The WardsAuto forecast shows European automakers taking an 8.5% market share, vs. 8.8% in like-2013, with total sales falling 4% to 101,000 units. Daimler brands are forecast to lead the way, with projected deliveries of 30,000 units, followed by Volkswagen and BMW.

At forecast levels, year-to-date sales through February would hit 2.2 million units, down 1.5% from same-period year-ago.