Rising demand in North and South America and China continues to be tempered by poor vehicle sales in Europe and most of the Asia-Pacific region.

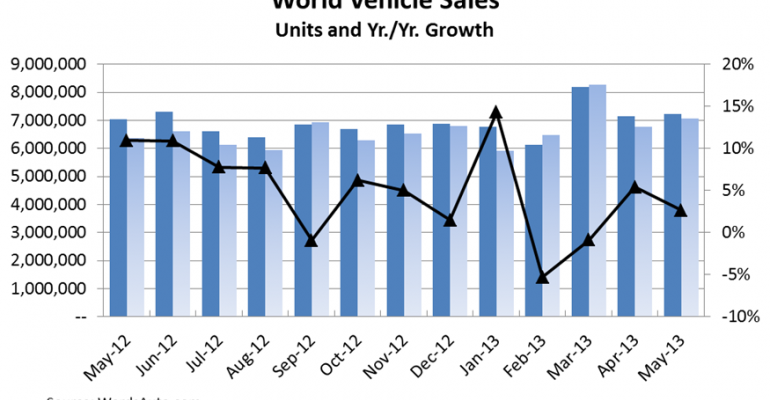

Global auto makers delivered 7.24 million units in May, a 2.6% gain over year-ago, according to WardsAuto data. It was the industry’s second-highest volume in 2013, behind March’s 8.19 million, and nearly 100,000 units higher than April’s tally, though not all markets fared equally well.

North America posted the largest volume increase over like-2012, outpacing year-ago by 119,000 deliveries (up 7.4%). It was the region’s 24th consecutive month of year-over-year growth.

The resulting 1.75 million sales equated to a 24.1% share of global auto sales, the region’s highest take since August.

Deliveries in the U.S. rose 7.7% in May to 1.47 million units, in line with year-to-date comparisons.

Canada increased 5%, with light-vehicle deliveries coming within 0.5% of that market’s record for the month, and Mexico set a new LV high for May, as total sales jumped 9% over year-ago to 90,456.

South America’s growth rate led all regions for the second straight month, with deliveries soaring 13.2% to 513,000. The 60,000-unit increase primarily came from the region’s three largest markets, Brazil (up 9.9%), Argentina (up 32.3%) and Chile (up 11.5%).

Brazil’s 316,000 deliveries made it the world’s fourth-largest vehicle market for the second straight month, behind only China, the U.S. and Japan.

South America accounted for 7.1% of May volume, compared with 6.4% year-ago.

Sales in the Asia-Pacific region rose 2.9%, compared with 1.6% in April, on 3 million units. In China, auto makers delivered 1.76 million vehicles, lifting the world’s largest market 9.4% over year-ago.

But sales were not as good in the rest of the region, where the second-, third- and fifth-largest markets of Japan (down 6.9%), India (off 9%) and Thailand (down 3.4%) all suffered declines.

Demand in South Korea, the fourth-largest market in the region, was flat, and sales in Indonesia, a growth engine for most of the past 24 months, rose just 4.2%, the country’s smallest gain since August.

Hopes that Europe’s slim year-over-year sales in April might signal a turning point were dashed in May. Deliveries fell 6.3% from like-2012, making May the 17th month of the past 18 to record a decline.

The resulting 1.62 million sales accounted for 22.3% of world volume, compared with 24.5% year-ago.

Of Europe’s top five markets, only the No.3 U.K. showed improvement, posting an 8.9% gain. Regional volume-leader Germany experienced a 9.9% sales drop, recording its worst May since 2010.

Russia, the region’s second-largest market, saw sales fall 11.8% for its third consecutive monthly decline and its worst year-over-year performance in 39 months. France (down 10.5%) and Italy (off 7.8%) also underperformed the prior year.

Europe’s ongoing economic crisis has proven the last hurdle to a worldwide auto industry recovery. Year-to-date, global vehicle sales are up 3.5% over like-2012, 6.5% if Europe is excluded.