A new WardsAuto forecast calls for U.S. light-vehicle deliveries to rebound from two months of below-trend demand hampered by unusually harsh weather and slow fleet sales.

The report pegs U.S. LV volume at 1.48 million units this month, equating to a daily sales rate of 56,929 (over 26 selling days), a 6% improvement over same-month year-ago (27 days).

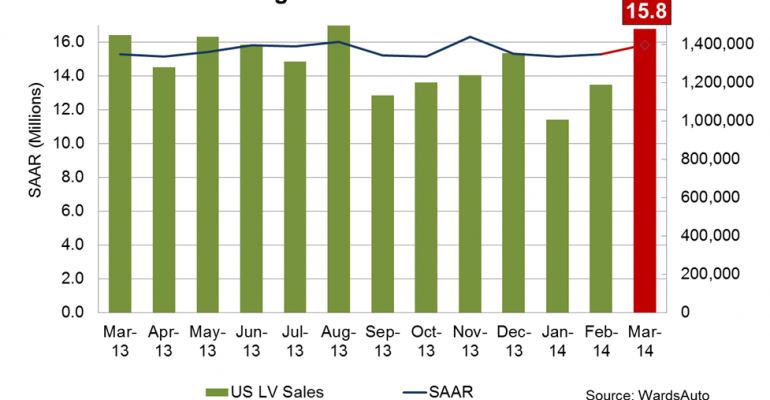

The projected 15.8 million-unit seasonally adjusted annual rate would be the highest since November’s 16.3 million and more than 600,000 units above the current 15.2 million-unit 3-month SAAR.

The forecast reflects a return to Q4 2013 sales levels, augmented by pent-up demand resulting from extreme winter weather across the country during the prior two months.

Relatively stable consumer confidence and the addition of 175,000 new jobs to the U.S. economy in February – a better-than-expected result – also factor into the optimistic outlook.

Inventory levels should continue to fall in March. With increased sales and steady production, the days’ supply of vehicles is expected to drop to 65 by the end of the month, down considerably from the industry’s 89 days’ supply just two months ago.

The WardsAuto forecast calls for Detroit Three daily sales to rise nearly 8% above year ago, accounting for a combined 45.5% market share, vs. 44.8% year-ago.

General Motors’ DSR is expected to rise 11% year-over-year to 263,000 units, buoyed by improving large-pickup sales, giving GM a 17.8% share of the overall LV market.

Ford deliveries should remain flat with its strong year-ago result, with the automaker accounting for 15.1% of the market this month on 223,000 units. Chrysler’s forecasted 13.4% improvement over year-ago DSR equates to 186,000 deliveries and a 12.6% share.

Daily sales by Asian automakers are expected to rise 3.6% from year-ago to 669,000 units, for a combined 45.2% market share. Group leader Toyota’s volume is expected to be flat with year-ago, at just below 200,000 units, accounting for 13.3% of industry sales. Honda daily sales are forecast to fall 4% on 125,000 deliveries.

Nissan should lead all of the top seven automakers with a 16.2% year-over-year improvement, while outpacing Honda for the second consecutive month. The forecast calls for the automaker to move more than 150,000 units in March. Subaru is expected to show the fastest growth among all automakers, with a year-over-year rise of more than 27%.

WardsAuto forecasts European automakers to take an 8.4% market share, vs. 8.7% in like-2013, with total sales rising 3% to 125,000 units. BMW and its Mini brand are expected to lead the group with 32,000 units combined, nosing ahead of Daimler brands’ projected 30,000.

At forecast levels, year-to-date sales through March would come to 3.6 million units, nearly identical to first-quarter year-ago.