This is the third in a series of reports on the health of the North American auto industry. Thursday: Suppliers

Mexico, for many years a hub for low-cost component and vehicle assembly, is poised to cement itself as a global automotive force in the coming years as expanding auto makers and suppliers add capacity to build an additional 600,000 vehicles annually.

Such growth might suggest the domestic vehicle market is emerging and that household incomes are rising to the point more Mexicans can purchase the cars they build.

That’s hardly the case.

According to WardsAuto projections, 80% of the country’s production is exported, and that is unlikely to change through 2018.

“There are a lot of people that would like to have a car but can’t afford one, but it’s coming,” says Gerardo Gomez, who is based in Mexico City as director and country manager for J.D. Power and Associates Mexico operations. “The economy is getting better, but there is still a ways to go.”

Mexico’s light-vehicle sales bolster Gomez’s assessment. The Nissan Tsuru, a rebadged Sentra that is four generations behind the model sold in more mature markets, is the top-selling vehicle.

“The key thing is affordability,” Gomez says, adding the Tsuru resides in the “popular” segment, a term used in the Mexican auto industry. “Nissan is playing in the popular segment because of the price, and they have a competitive vehicle for that segment.”

In a country of 112 million people, only 0.5% of the population can either drive or afford to purchase a vehicle, Gomez says.

In a country of 112 million people, only 0.5% of the population can either drive or afford to purchase a vehicle, Gomez says.

There are 300 vehicles per 1,000 people in Mexico, compared with 809 vehicles per 1,000 people in the U.S.

Even without strong demand locally, Mexico can bank on continued growth and investment from auto makers and component producers. Already favored as a production hub due to its proximity to the U.S., the country will add new assembly plants in the coming years from the likes of Audi, Mazda, Honda and Nissan.

Honda in March laid the foundation stone for the construction of its new production facility in Celaya, Guanajuato, to begin output of the Honda Fit subcompact in 2014.

Mazda joined Honda with its own plan to erect a new plant in the central state of Guanajuato, to build the next-generation Mazda2 and Mazda3 beginning in 2014. The factory will have capacity for about 140,000 units annually.

Mazda says the new operation will make a Toyota-brand vehicle, based on the Mazda2, for sale mainly in North America. Production is set for summer 2015 at a pace of 50,000 units annually.

Long-standing rumors that Audi was planning a site in Mexico were confirmed in 2012 when the German luxury auto maker said it had chosen San Jose Chiapa, Puebla, for the location. Scheduled to begin production in 2016, the factory will begin building the Q5 cross/utility vehicle and have initial capacity for about 160,000 vehicles annually.

Nissan, which has the largest presence in Mexico among Japanese auto makers, is investing $2 billion in its third assembly plant in Aguascalientes. The facility is slated to open in late 2013 and bring the company’s direct employment in the country to nearly 13,500. Nissan has yet to announce what models will be built there.

With the expansion, Nissan will become nearly as large as Volkswagen in Mexico. VW employs more than 15,000 workers at its sprawling Puebla complex.

With the expansion, Nissan will become nearly as large as Volkswagen in Mexico. VW employs more than 15,000 workers at its sprawling Puebla complex.

But it may not be long before Nissan surpasses VW’s footprint in Mexico. Nissan CEO Carlos Ghosn recently hinted another factory may be on the way.

“We will need capacity in North America and, yes there is a high probability that in the future we will be announcing a new plant in Mexico or in the U.S.,” Ghosn tells Bloomberg during an appearance in Mexico City.

Some auto makers already operating in the country are investing in upgrades for their facilities, including Ford, which earlier this year pumped $1.3 billion into its Hermosillo factory to accommodate production of the ’13 Ford Fusion and Lincoln MKZ midsize sedans.

Others making significant investments in existing operations include General Motors and Fiat.

Germany-based Daimler and BMW reportedly are considering sites as well, although no concrete plans have emerged.

Mexico currently has capacity to produce 2.6 million vehicles annually, and WardsAuto forecasts an increase to 3.2 million units in 2015 and 3.5 million in 2017, based on growth from Honda, VW, Mazda and Nissan.

The forecast is based on straight-time capacity and includes the potential for third shifts.

As auto makers expand in the country, component suppliers are following suit. Eaton Automotive has three plants manufacturing valvetrain, torque-control and vapor-management products, says Jake Hooks, president of Eaton’s North American automotive business.

“There was a slowdown for a period of time, driven by the economic downturn and the restructuring of the North American auto industry,” Hooks tells WardsAuto. “But now the activity has really accelerated.”

Eaton Automotive has 1,100 employees in the country. “Right now, we are expanding what we have. We’re adjusting within our facilities,” he says.

“With the events of the last three years – the tsunami in Japan and flooding in Thailand – there has been acceleration of localization of manufacturing in North America,” Hooks says. “OEMs are looking at the global supply chain. That’s why you see Japanese and Korean OEMs and European OEMs putting additional local content into North America.”

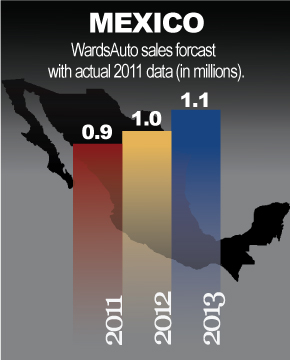

Gomez says 1 million light vehicles are expected to be sold in Mexico in 2012. But if the U.S. economy improves, he expects growth. WardsAuto forecasts 2013 vehicle sales will rise slightly to 1.1 million units.

“The economy is getting better, but it’s also dependent on the U.S. economy,” Gomez says. “We’re watching the U.S. economy very closely. Mexicans are starting to get more cash, but just a little bit, not much. They’re just trying to replace old vehicles.”

Going forward, Mexico’s status as a growing automotive export country is cemented, but much of its output likely will go to the U.S. The European market is under duress, burdened with overcapacity, and won’t receive many exports from Mexico, with the exception of Germany.

Smaller South American countries such as Peru and Columbia will absorb some of its exports, but not at high volumes. Brazil, the largest of the region's auto markets, represents the biggest recipient outside North America for Mexican exports, but there are issues that must be addressed.

In February, the Brazilian government announced its intention to renegotiate its trade agreement with Mexico, arguing the pact was threatening Brazil’s domestic automotive industry. The two countries in March inked a 3-year agreement that placed a quota on the number of Mexican-made light vehicles that could be shipped to Brazil.

Under terms of the agreement, the value of Mexican vehicle exports to the country were cut to $1.4 billion annually, less than a third of the value of 2011 exports.

The quota was used up within six months of being signed, and since then Brazil has announced it will accept an additional 4,800 imported vehicles. But that number includes all countries that export to Brazil, not just Mexico, says Augusto Amorim, lead South America and Mexico analyst for auto industry consultant Polk.

The increase is a “relief for Mexico,” Amorim tells WardsAuto. “Mexico has just elected a new president, and he has already gone to Brazil and said he’s willing to negotiate the agreements again.”

President-elect Pena Nieto, who will take office Dec. 1, has declared Mexico open for business. In protecting commercial interests, he also must crack down on rampant violence associated with drug dealing near the border with the U.S.

Nieto has vowed to curb the violence, which has claimed nearly 60,000 lives since President Felipe Calderon took office in 2006.

Auto makers have taken security measures to protect high-ranking officials visiting facilities in the country, including banning apparel with company logos, alternating drive routes to the plants and staying in hotels in regions deemed safe.

The violence, however, is unlikely to affect auto industry growth, Amorim says. “It’s a big issue in Mexico, but (Polk) doesn’t see it hurting production there.

“We see (production) growing in Mexico in the next few years because of (improved) labor conditions and free-trade agreements, and we see OEMs shifting production from Canada to Mexico.”

– with Tom Murphy