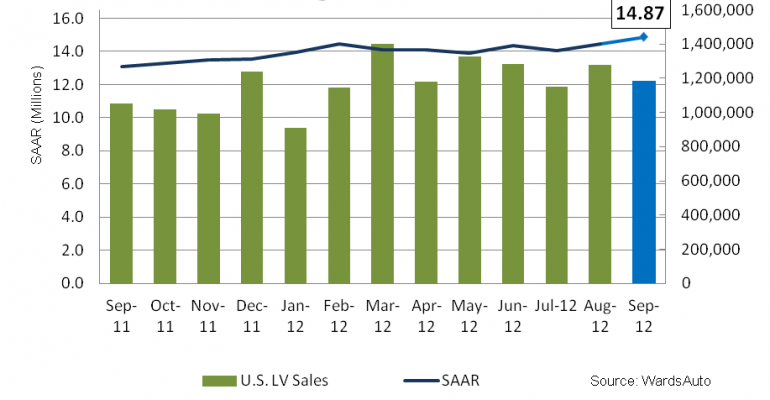

U.S. light-vehicle sales surged in September to a 54-month-high seasonally adjusted annual rate and marked the 25th consecutive monthly increase year-over-year.

Consumers seeking fuel economy appeared to dominate the market, as small and midsize cars posted strong gains while large trucks continued to stumble.

Honda, Toyota and Volkswagen continued their strong performances from August, propelling the industry’s overall gain with some help from Chrysler.

Industry volume totaled 1.184 million units in September, equaling a daily rate of 47,352 vehicles, 12.7% above year-ago’s 42,013 – 25 selling days both periods. Deliveries have increased every month since a 17.9% year-over-year decline in August 2010.

To-date volume through September is 14.5% ahead of like-2011.

The month’s 14.9 million SAAR marks the highest tally since a similar result in March 2008. The year-to-date SAAR increased to 14.24 million from the prior month’s 14.16 million.

Cars, which set a record in August for average fuel economy, according to the WardsAuto Fuel Economy Index, might well have done so again in September.

Sales of small cars increased a whopping 43.5% from year ago, and midsize cars were up a strong 17.5%. If not for lean inventory on some models, midsize cars might have been even stronger.

On the opposite end, sales of large light trucks – large pickups and vans and large/luxury SUVS and CUVs – fell 7.3% in September. That pushed the year-to-date share for large trucks down to 17.2%, from 18.5% in like 2011.

Among the major manufacturers, Toyota led with a 41.5% sales increase over year-ago, outrunning Ford for the second time this year on volume of 171,910 units. Toyota’s results followed a 42.0% increase in August and boosted its year-to-date gain to 31.6%.

Ford recorded a 0.9% drop from year-ago, largely due to lean inventory of its redesigned Ford Fusion and Escape. It was its first decline since August 2010.

Ford’s market share dropped to 14.4% compared to year-ago’s 16.4%, the third time this year its penetration slipped below 15% and marking its lowest share since 13.9% in August 2009. To date through September, Ford controls 15.3% of the market, down from year-ago’s 16.6%.

Honda posted 30.9% increase over like-2011, boosting year-to-date sales 24.0%.

Volkswagen/Audi recorded a 32.3% rise over year-ago, its 36th straight gain. VWA’s 4.1% September market share barely edged Kia’s penetration, but its year-to-date share of 3.9% still lags the latter’s 4.0%, as the two vie for seventh place.

Chrysler sales rose 11.7% from year-ago, the 30th consecutive increase, while Nissan sales slipped 1.1%, its first decline since May 2011.

Other manufacturers recording September increases included BMW (3.5%), Daimler (8.8%), Hyundai (15.3%), Jaguar/Land Rover (11.1%), Porsche (26.1%) and Subaru (32.2%).

In addition to Ford and Nissan, others with declines were Mazda, Mitsubishi, Suzuki and Volvo.