NEW YORK – Auto sales ultimately will ebb, and that should come as no surprise if history is a guide for an up-and-down industry.

So says John Humphrey, J.D. Power’s senior vice president-global automotive, citing the cyclical nature of the auto business.

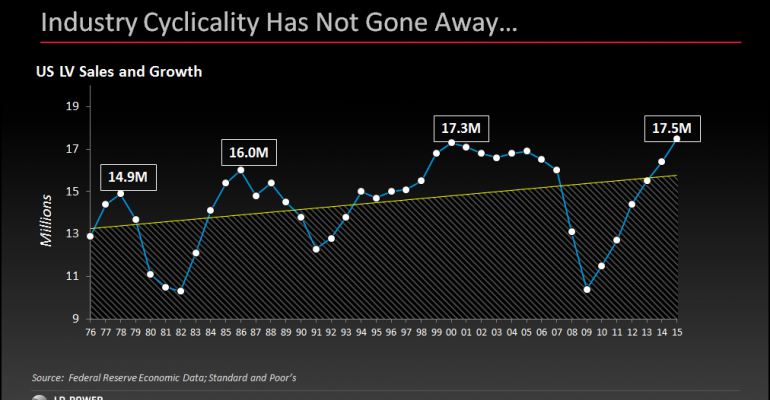

“Industry cyclicality has not gone away, it hasn’t changed,” he says, disputing a temptation to think today’s brisk U.S. auto sales will last, if not forever, then a long time yet.

That won’t happen, Humphrey says. He cites data showing three significant sales downturns since the late 1970s. The worst occurred during the recession year of 2009. Today, he speaks of “clouds on the horizon.”

Auto-industry good times typically last six to nine years. “We are in the seventh year since the recession, so we are coming up on it,” he says at the 2016 Automotive Forum held in conjunction with the New York International Auto Show.

U.S. auto sales hit 17.4 million last year, representing a steady climb since the trough of 10.6 million units in 2009. WardsAuto predicts record-breaking deliveries of 17.8 million this year but then a curtailment.

Globally, automakers sold about 92 million vehicles last year, a 3.2% increase. “On that type of volume, anyone would take 3.2%,” Humphrey says. But he issues warnings there, too.

One of them is that despite sales closing in on 100 million, automakers’ global production capacity is 135 million vehicles. Some markets are better off than others.

For example, the U.S. auto industry does a good job of matching production to demand, currently operating at 94% capacity, Humphrey says.

That compares with China, the world’s largest auto market, with a production capacity of 43.7 million vehicles but actual production of 25.3 million,

Other countries are worse off: Brazil operates at 33% capacity and Russia, 35%.

Those two countries once were considered hot prospects, but both now are in the depths of “deep, deep recessions,” says Nariman Behravesh, IHS’s chief economist.

“A lot of money went into production facilities and dealership networks in those markets,” Humphrey says, adding Brazil and Russia, although once “highly hyped” as automotive markets, never approached meeting expectations.