Don’t be fooled by the current gas-price moderation, and be prepared to fill up with E85 when the time is right, experts advise.

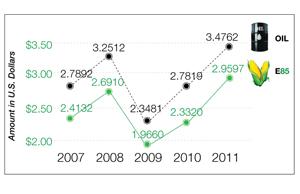

The prevailing gas-price trajectory is upward, unlike E85’s more stable trend line. This sets up a cost-benefit scenario that favors E85, say backers of the gasoline-ethanol blend.

The tipping point is somewhere north of $4 for a gallon of regular-grade gas, says Mark Maher, executive director for Powertrain and Vehicle Integration at General Motors. When that inevitability occurs, “I would certainly expect a surge in E85 demand,” he tells Ward’s.

“We need to see about a 20%-25% price differential between gas and E85 in order for E85 to be a good value on an energy basis, and there are many places around the country with that price differential.”

Illinois and New York are two, according to American Automobile Assn. data. In Illinois, where gas recently averaged $4.17 and E85 was $3.44, the spread was 21.2%; and in New York, where the fuels sold last week for $4.13 and $3.40, respectively, the differential was 21.5%.

There are about 10 million E85-compatible vehicles on the nation’s roads, according to the U.S. Department of Agriculture. Yet the fuel is not widely used.

One reason is availability. Of the 140,000 filling stations in the U.S., only 2,700 sell E85.

Underlying this disparity is the value proposition. Because gasoline packs more punch than E85, the cost-benefit of burning the latter is marginal when they are similarly priced.

Historically, there has been a direct correlation between gas-price increases and the advantage of refueling with E85. On July 17, 2008, when the national average per-gallon price of gas price spiked to a record $4.11, E85 retailed for $3.33 a gallon – a 23.4% spread.

This year, to date, the peak price of a gallon of gasoline is $3.98 vs. $3.34 for E85, representing a 19.2% differential.

In Brazil, where sugarcane-derived ethanol is the dominant fuel, GM distributes a cheat sheet for consumers. It “shows you what a good buy is on a given day based on fuel prices,” Maher says.

For example, if gasoline in Brazil is BR1.50 ($0.92) per liter and ethanol is at BR1.00 ($0.61) – a 50% price advantage – the chart recommends ethanol.

The AAA publishes a daily chart that adjusts U.S. average E85 per-gallon prices for energy content, expressed in British Thermal Units. That price always is higher than the price of gasoline.

Last week, AAA’s BTU-adjusted price for E85 was $4.34, compared with $3.91 for gas, indicating the latter currently provides more bang for the buck.

But E85 boosters cry foul when comparisons are made without accounting for variations in purity.

![<link rel="stylesheet" href="http://subscribers.wardsauto.com/galleries/files/lightbox.css" type="text/css" media="screen" />

<script src="http://subscribers.wardsauto.com/galleries/files/prototype.js" type="text/javascript"></script>

<script src="http://subscribers.wardsauto.com/galleries/files/scriptaculous.js?load=effects" type="text/javascript"></script>

<script src="http://subscribers.wardsauto.com/galleries/files/lightbox.js" type="text/javascript"></script>

<p><a href="http://subscribers.wardsauto.com/galleries/2011/Brazil-gallery1.jpg" rel="lightbox[plants]" title=" GM Brazil tag helps consumer choose between ethanol and gas depending on price.">View Chart Larger</a></p>](http://subscribers.wardsauto.com/images/2011/05/Brazil-ethanol-chart.png)

Some 95% of all gasoline sold in the U.S. contains an average of 10% ethanol, according to The Renewable Fuels Assn. But E85 detractors often do not account for that 10% when calculating energy density, says Robert White, RFA market-development director.

Further skewing comparisons is the fact E85 often contains as little as 70% ethanol, says White, who pegs gasoline’s potency edge between 15%-20%.

“And that varies depending on every vehicle, every driver and road conditions,” he adds.

The U.S. government has been staunch proponent of E85 use. Since 2000, there has been a federal requirement that 75% of all government-fleet light-vehicle purchases run on alternative fuel, whether it be E85, propane, natural gas or electricity.

Additionally, there exists a alternative-fuel tax credit on vehicle purchases. The credit is expires at year’s end, but White expects an extension.

Most industry observers agree consumers will not give greater consideration to the fuel until availability improves.

White says E85 pump penetration was hampered from 2006-2010 due to a labor-intensive equipment-certification process. That was resolved in June 2010 when Underwriters Laboratories sanctioned dispensing systems that accounted for E85’s corrosive properties. “Progress has been steady since,” he adds.

The RFA says as many as seven new E85 pumps are added to the nation’s fuel infrastructure every week.

GM has been working with big-box retailers such as Costco and Meijer to install E85 pumps. “If the price difference stays where it is, it will interest a lot of (fuel stations),” Maher adds.

The government also is working to bolster the infrastructure with a mandate for the installations of 10,000 flexible fuel pumps nationwide during the next five years, according to the USDA.

In the last week, the national per-gallon price of regular-grade gas has fallen some $0.10, according to AAA data. But consumers who regard this as a permanent trend are harboring false hope, warns Tom Kloza, chief analyst for the New Jersey-based Oil Price Information Service.

“Spring spikes are traditional, and price softness that follows in May, June and July are traditional as well,” he tells Ward’s, suggesting consumers consider a range of gas prices, instead of extreme highs or lows, when contemplating vehicle purchases.

And that range likely should be $2.75 to $5. “We will see $5 (per gallon) and greater average prices this decade,” Kloza says. “Folks should not get a new set of complacency by prices that could be as low as $3.25 in the next 60 days.”

– with Eric Mayne