Related document: 2010 Ward's Dealer F&I 150 Chart

CHICAGO – Back in 1992, when Bill Clinton ran for his first term as president, a catch phrase captured voters' attention: “It's the economy, stupid.”

It still is. Beyond the overall economy, which remains in a state of recovery, it’s a question of jobs. Without one of those, most Americans simply won’t be buying a car – certainly not a new one or a late-model used vehicle.

“We're still light-years away from what we went through in the Great Depression,” says Mark Vitner, managing director and senior economist at Wells Fargo Securities.

Yet, “the labor market is still dismal; only marginally better than it was in the depth of the recession,” he says at the Automotive Economic Forecast and Financial Forum.

Lack of a job with adequate earnings keeps many potential car-buyers away from dealership showrooms, Vitner says.

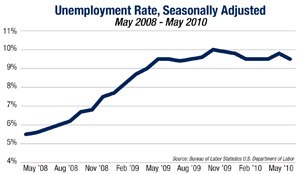

The number of unemployed persons was 15.0 million in May.

The unemployment rate edged down to 9.7%, the same rate as in the first three months of 2010. In October, the official unemployment rate peaked at 10.1%

March saw growth of 230,000 jobs nationally, followed by 290,000 in April. The increase escalated to 431,000 in May, but 411,000 of those were temporary census jobs.

Special Report

2010 Ward’s Dealer F&I 150

2010 Ward’s Dealer F&I 150

Half of job growth this year has been in low-paying jobs, in such areas as retail and the hospitality industry. Some 65% of that growth has been in part-time employment.

“As consumers begin to get re-employed, they’ll be ready to buy cars,” says Ford Motor Co. Chief Economist Ellen Hughes-Cromwick. Until then, don’t look for them at dealerships.

Even when job growth is well into six figures, that's not necessarily good news. Why? Because the overall labor force – people ready to work – grows by about 125,000 each month. Unless those people are absorbed into the workforce, unemployment will either stagnate or increase.

Unemployment has topped 12.5% in the Southeast, Vitner says. The Midwest and California have been hit especially hard.

Americans are out of work for longer periods than in the past, which also keeps them out of the car market. Average duration of unemployment reached 31 weeks in April.

Discouraged workers who’ve given up trying to find jobs aren’t counted at all in the official statistics.

Potential re-entrants and new entrants into the workforce likely will account for a larger share of the unemployment rate.

One reason is that in June, many people will complete 18- to 24-month programs in community colleges. Many of those new graduates will find their educational effort hasn’t paid off.

“Because of the depth of this recession, it was hard to decide what to be re-trained for,” Vitner says, noting that youth unemployment, in particular, has been the worst in years.

![<link rel="stylesheet" href="http://subscribers.wardsauto.com/galleries/files/lightbox.css" type="text/css" media="screen" />

<script src="http://subscribers.wardsauto.com/galleries/files/prototype.js" type="text/javascript"></script>

<script src="http://subscribers.wardsauto.com/galleries/files/scriptaculous.js?load=effects" type="text/javascript"></script>

<script src="http://subscribers.wardsauto.com/galleries/files/lightbox.js" type="text/javascript"></script>

<p><a href="http://subscribers.wardsauto.com/galleries/2010/unemployment-chart-gallery.jpg" rel="lightbox[plants]" title="">Enlarge Chart</a></p>](http://subscribers.wardsauto.com/images/2010/06/unemployment-chart.jpg)

Even if people with a shaky job status venture into a dealership, many who want to buy a car might not qualify for financing under today’s stricter loan standards that focus on high credit scores and hefty down payments.

Banks and captive lenders are especially wary. During the first quarter-2010, lending shrunk by $49.8 billion, according to Experian Automotive. Captive lenders were responsible for $24 billion of that drop, and banks for $18 billion.

Neither lenders nor dealers are in the mood to take undue chances offering loans to unqualified applicants or approving credit for excessive amounts.

More and more consumers are trapped in a “Catch 22” dilemma. They can't afford a car due to lack of money and/or a job, but need one to get to work or look for work.

Dealers seeking new prospects in the current environment have choices. Among them:

- When customers cannot be financed for a desired vehicle, offer a less-costly used alternative. For a person struggling financially, it’s not the time to shop for an option-laden car of your dreams.

- EConsider factors beyond credit scores and loan history – carefully, but imaginatively. Some people with unappealing credit scores or no loan history at all would be reliable loan risks, if approved. Conversely, some consumers with good credit will default when things get tough, especially if they're overloaded with credit.

Nobody ever said making loan decisions would be easy, especially in a time of economic turmoil.