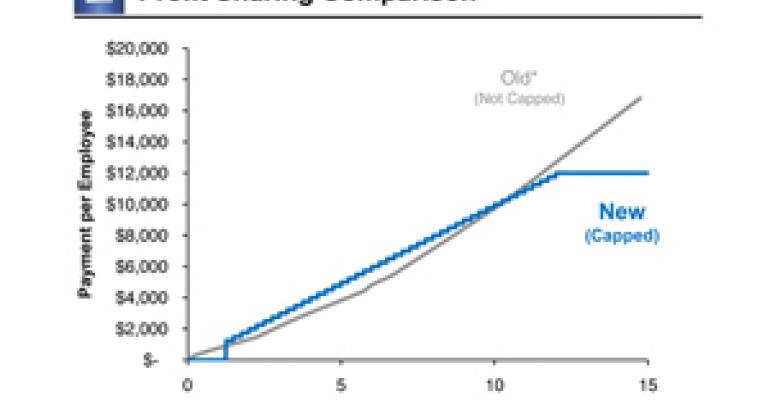

A revised profit-sharing program that caps employee payouts while enabling General Motors to pocket increasing amounts of cash actually favors workers, at least short term, industry observers and insiders say.

The new profit-sharing formula, contained in the 4-year GM labor contract ratified this week by the United Auto Workers union, rewards eligible hourly workers with $1,000 for every $1 billion of full-year earnings – before interest and taxes – recorded by GM’s North American operations.

![<link rel="stylesheet" data-cke-saved-href="http://subscribers.wardsauto.com/galleries/files/lightbox.css" href="http://subscribers.wardsauto.com/galleries/files/lightbox.css" type="text/css" media="screen" />

<script data-cke-saved-src="http://subscribers.wardsauto.com/galleries/files/prototype.js" src="http://subscribers.wardsauto.com/galleries/files/prototype.js" type="text/javascript"></script>

<script data-cke-saved-src="http://subscribers.wardsauto.com/galleries/files/scriptaculous.js?load=effects" src="http://subscribers.wardsauto.com/galleries/files/scriptaculous.js?load=effects" type="text/javascript"></script>

<script data-cke-saved-src="http://subscribers.wardsauto.com/galleries/files/lightbox.js" src="http://subscribers.wardsauto.com/galleries/files/lightbox.js" type="text/javascript"></script>

<p><a data-cke-saved-href="http://subscribers.wardsauto.com/galleries/2011/gm-gallery.jpg" href="http://subscribers.wardsauto.com/galleries/2011/gm-gallery.jpg" rel="lightbox[plants]" title=" ">View Chart Larger</a></p>](http://subscribers.wardsauto.com/images/2011/09/gm-profit-chart.jpg)

Payouts are capped at $12,000, even if profits exceed $12 billion, leaving the auto maker to keep more of its earnings as they escalate. Alternately, the new profit-sharing program stands to outperform the previous deal if GM North America turns in moderate profits in the range of $1 billion to $8 billion.

“The chance of GM having a really good year in the next three to five years is extremely low – near-zero,” notes Toronto-based industry analyst Dennis DesRosiers.

On the heels of its $2.5-billion second-quarter profit, GM forecast a “modestly lower” EBIT total for second-half 2011, compared with like-2010, but maintained its full-year performance will “show solid improvement.”

Through August, GM’s U.S. sales were tracking 16% ahead of prior-year, according to WardsAuto data. But that comparison favors current delivery trends because the market was suffering the lingering effects of 2009’s historic, recession-induced plunged, DesRosiers warns.

GM is more likely to have a “blow-the-doors-off-year” in the 2017-2020 time frame, just after the new labor agreement expires, putting the UAW in position to capitalize. “What this does is set them up for the next round of contract negotiations,” he tells WardsAuto.

Under terms of the previous UAW-GM contact, profit-sharing checks – paid on the pre-tax earnings of the auto maker’s U.S. operations – were based on a sliding scale that afforded escalating employee payouts.

So in a stellar year of $15-billion profits, UAW members stood to collect some $17,000 each.

“But that’s never happened,” says a UAW source close to this year’s GM contract talks.

If the new formula were in place last year, eligible GM workers would have received $5,700 each on the $5.7 billion EBIT total generated by the auto maker’s North American operations.

Instead, they received $4,300 – the biggest profit-sharing checks awarded by GM since the program was adopted in the 1980s.

Historically, the auto maker has been the Detroit Three’s poor sister when it came to profit-sharing payouts. Since the system was adopted in the 1980s, GM has distributed a total of $12,000 per eligible employee.

The peak payout at Chrysler was $8,100 in 1999. Ford employees collected their biggest checks, $8,000 on average, a year later.

The previous profit-sharing plan was the same at all three companies. Contract talks continue between UAW negotiators and their counterparts at Ford and Chrysler.

Profit-sharing has been a major issue at the bargaining table this year. While valuable to GM, Ford and Chrysler as a hedge against labor costs, the previous plan proved overwhelmingly complicated.

“Members felt like they didn’t understand the calculation, and they didn’t know how much they were getting,” the UAW source says.

For starters, payouts were based on the performance of an auto maker’s U.S. operations – a number not routinely included in financial statements. However, profit-loss totals for North American operations are a fixture in such reports.

“The big winner actually is the UAW,” says John Beck, associate director of Michigan State University’s School of Human Resources and Labor Relations. “This (contract) is about solidifying State-side jobs.”

As part of the deal, GM commits to invest $2.5 billion in its U.S. operations, a move that will retain or create 6,400 jobs for UAW members.

Says Jim Graham, president of UAW Local 1112 in Lordstown, OH: “We are ecstatic.”

Local 1112 members, historically among the most militant of GM’s hourly workforce, voted 74% in favor of the contract.

“My plant was good with it,” Graham says of the new profit-sharing language. “I feel so good right now.”

That warm, fuzzy feeling apparently is spreading. GM stock rose $0.35 to $20.76 the day after UAW members ratified the agreement, which adds just 1% per year to the auto maker’s labor costs.

Against this backdrop, Standard and Poors’ has increased GM’s debt rating to BB+, one notch below investment grade, from BB-.

GM Chief Financial Officer Dan Ammann welcomes the news. “Our fortress balance sheet and low breakeven point are helping us succeed even in uncertain economic times, so we can stay focused on building great products and driving profitable growth around the world,” he says in a statement.

– with James M. Amend and Byron Pope