Finance & Insurance

thumbnail

Finance & Insurance

Industry Voices | Best Practices to Ensure Digital Deal Jacket SecurityIndustry Voices | Best Practices to Ensure Digital Deal Jacket Security

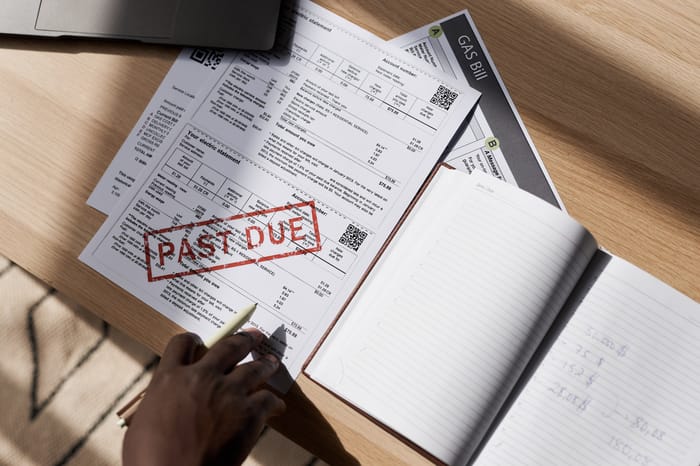

If the information contained in a deal jacket falls into the wrong hands, it can lead to identity theft, financial fraud and a host of other malicious activities.

Subscribe to a WardsAuto newsletter today!

Get the latest automotive news delivered daily or weekly. With 6 newsletters to choose from, each curated by our Editors, you can decide what matters to you most.

.jpg?width=100&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)