NADA Chief Says Tesla Should Embrace Dealer Franchise SystemNADA Chief Says Tesla Should Embrace Dealer Franchise System

Tesla has battled state laws requiring vehicles to be sold through a franchise dealer, arguing consumers don’t like dealing with a middleman and conventional dealers are not equipped to sell electric vehicles.

DETROIT – Tesla founder Elon Musk has told the National Automobile Dealers Assn. he will embrace the dealer franchise model that’s prevalent in the U.S. once sales of his cars reach critical mass, David Westcott, chairman-NADA, says.

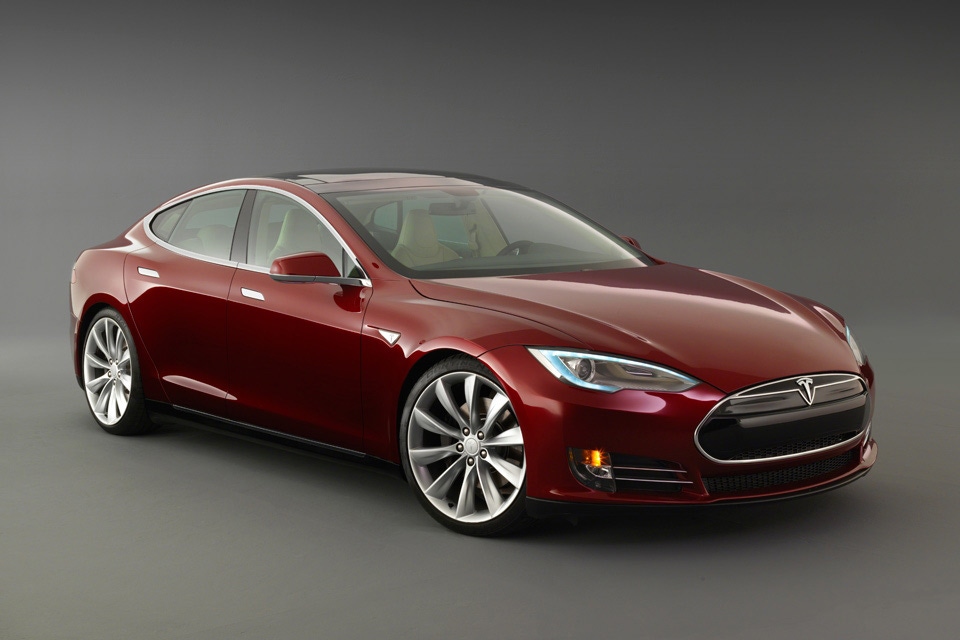

“(Musk) is an interesting individual, and the car is wonderful,” Westcott says at an Automotive Press Assn. event here. “The only thing we differ on is the distribution system.”

Tesla has battled state laws requiring vehicles to be sold through a franchise dealer, arguing consumers don’t like dealing with a middleman and conventional dealers are not equipped to sell electric vehicles.

Westcott disputes that claim, noting franchise dealers have sold more than 500,000 electric and other alternative-powered vehicles so far this year.

“We know how to market cars,” he says. “Dealerships around the country have a lot of specialists in accessories or certain products, so we know how to make a distinction.”

In some states, such as Texas, Tesla has established showrooms to circumvent dealer-franchise laws that exist in every state. The showrooms are for displaying vehicles only, and staff are not allowed to offer test drives or provide pricing information. Consumers can buy a Tesla online and have the car delivered via a third-party distributor.

Westcott says the dealer-franchise system creates competition among dealers, resulting in better prices for customers, noting automakers such as Ford tried to sell vehicles directly to the public in the past and failed.

“If manufacturers were allowed to squeeze out independent dealers, the competition will give way to a handful of national and international corporations controlling pricing in your local community, because there will no longer be intra-brand competition,” he says. “Today’s intense competition at the dealer level would be replaced by inflexible pricing set by a handful of distant manufacturers unaware of and indifferent to local markets.”

Dealers also are valuable in other aspects, he says, noting they stock inventory to give customers choices, handle financing paperwork, offer repair services and give cash for trade-ins.

“Dealers remove complexity,” he says. “They provide essential services either required by the state or demanded by the customer.”

While Tesla is currently the only rogue automaker trying to establish a company-owned sales network, there are other threats to the system on the horizon, including Chinese automakers that are trying to gain a foothold in the U.S.

Westcott says he’s learned there are 62 Chinese automakers selling cars directly to consumers in Peru, and there is potential the same thing could happen in the U.S. once China-made vehicles are able to meet the country’s strict safety and emissions regulations.

“Who knows how that may evolve?” he says. “We’re not necessarily worried, but it’s in the back of everyone’s mind to some degree.”

Meanwhile, Westcott says offering loans to subprime buyers, a practice that largely disappeared during the height of the recession, has returned and is propping up car sales in the U.S. But the NADA chief isn’t concerned the insanity is headed down the same path that led to the 2009 recession.

“Subprime is back to where it should be. It had to be to sell cars,” he says. “We need that part of the segment.”

About the Author

You May Also Like